| Item 2.02 |

Results of Operations and Financial Condition |

Public Offering

On February 7, 2023, Xponential Fitness, Inc. (the “Company,” “Xponential,” “we,” “our,” or “us”) expects to file a preliminary prospectus supplement (the “Preliminary Prospectus Supplement”) with the Securities and Exchange Commission (the “SEC”) in connection with a proposed offering of shares of its Class A common stock. The Preliminary Prospectus Supplement will contain a summary of certain preliminary estimates regarding the Company’s financial results for the year ended December 31, 2022, as well as certain other operating data, which are set forth below.

We have prepared the following preliminary financial information to present our estimated results for the year ended December 31, 2022. We have prepared such preliminary financial information based upon our internal reporting and accruals as of and for the year ended December 31, 2022. Such estimates are preliminary and inherently uncertain and subject to change as we finalize our financial statements and operating data. There can be no assurance that our final results for the year ended December 31, 2022 will not differ materially from these estimates. During the course of the preparation of our consolidated financial statements and related notes, we may identify items that could cause our final reported results to be materially different from the preliminary financial estimates presented herein.

The preliminary financial estimates presented below have not been audited, reviewed or compiled by our independent registered public accounting firm. Accordingly, our independent registered public accounting firm does not express an opinion or any other form of assurance with respect thereto and assumes no responsibility for, and disclaims any association with, this information. In addition, the below information was not prepared with a view toward complying with the guidelines established by the American Institute of Certified Public Accountants with respect to prospective financial information but, in our view is reasonable, reflects the best currently available estimates and judgments, and presents our expected performance.

The preliminary financial estimates presented below should not be viewed as a substitute for full financial statements prepared in accordance with generally accepted accounting principles in the United States (“GAAP”). In addition, these preliminary financial estimates for the year ended December 31, 2022 are not necessarily indicative of the results to be achieved for any future period.

Preliminary Estimate of Results as of December 31, 2022

The Company estimates that for the year ended December 31, 2022:

| |

• |

|

revenue will be in the range of $241.4 million to $243.2 million, or an increase of 56% to 57% as compared to the year ended December 31, 2021; |

| |

• |

|

net income (loss) will be in the range of negative $3.0 million to positive $500 thousand; and |

| |

• |

|

adjusted EBITDA will be in the range of $71.3 million to $74.0 million, or an increase of 161% to 171% as compared to the year ended December 31, 2021. |

Adjusted EBITDA is a non-GAAP financial measure. See “Non-GAAP Financial Measures” below for a reconciliation of estimated Adjusted EBITDA to estimated net income (loss) and of estimated Adjusted EBITDA margin to estimated net income (loss) margin, the most directly comparable financial measures calculated in accordance with GAAP, respectively, for the year ended December 31, 2022.

Other Operating Data

The Company also reports that for the year ended December 31, 2022:

| |

• |

|

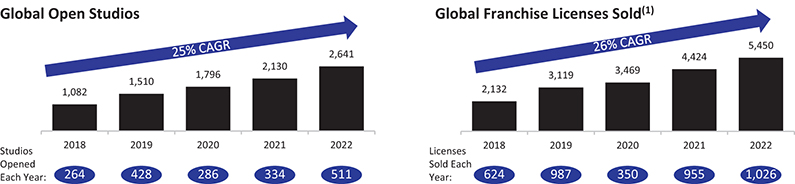

the number of global open studios grew from 2,130 as of December 31, 2021 to 2,641 as of December 31, 2022, representing an increase of 24%; |

| |

• |

|

global franchise licenses sold grew from 4,424 as of December 31, 2021 to 5,450 as of December 31, 2022, representing an increase of 23%; and |

| |

• |

|

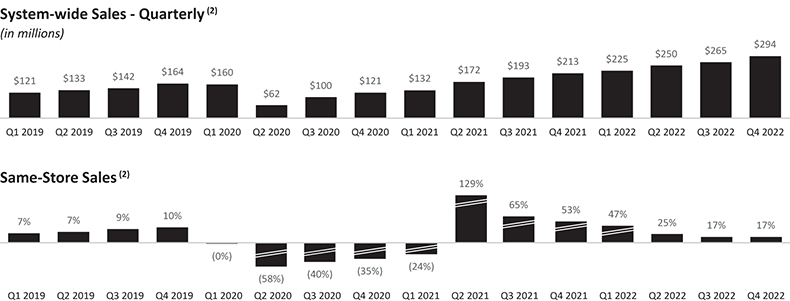

system-wide sales grew from $709.7 million in 2021 to $1.0 billion in 2022, representing an increase of 46%. |