The information contained in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where such offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated January 20, 2023

|

PROSPECTUS | |

| CLASS A COMMON STOCK | ||

| 20,065,479 SHARES |

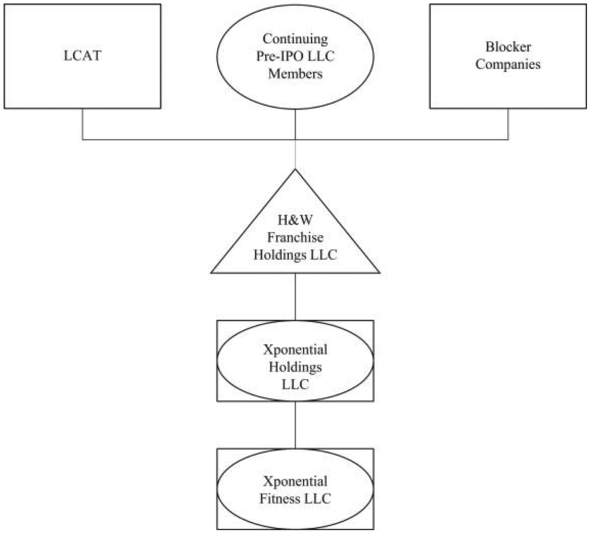

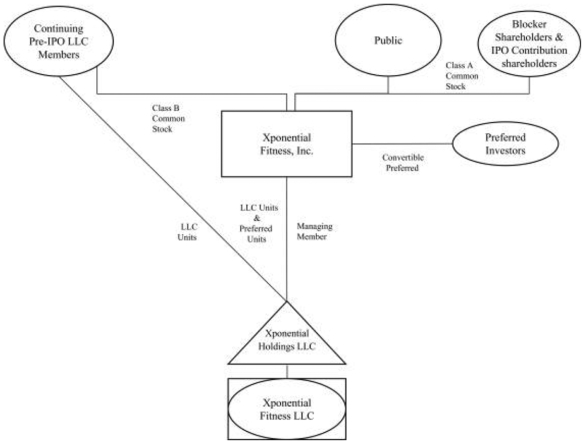

The selling stockholders identified in this prospectus are offering 20,065,479 shares of Class A common stock, par value $0.0001 per share of Xponential Fitness, Inc. (the “Company,” “we” or “us”). Our Class A common stock is listed on the New York Stock Exchange (“NYSE”) under the symbol “XPOF.” The last reported sale price of our Class A common stock on the NYSE on January 19, 2023 was $25.66 per share. We will not receive any proceeds from this offering. Prior to the consummation of an offering pursuant to this prospectus, the selling stockholders will exchange LLC Units for shares of our Class A common stock to be sold by them in the offering. See “Principal and Selling Stockholders” and “Organizational Structure.”

These securities may be offered and sold by the selling stockholders from time to time in accordance with the provisions set forth under “Plan of Distribution.” The selling stockholders may offer and sell these securities to or through one or more underwriters, dealers or agents, who may receive compensation in the form of discounts, concessions or commissions, or directly to purchasers, on a continuous or delayed basis. The selling stockholders may offer and sell these securities at various times in amounts, at prices and on terms to be determined by market conditions and other factors at the time of such offerings. This prospectus describes the general terms of these securities and the general manner in which the selling stockholders will offer and sell these securities. A prospectus supplement, if needed, will describe the specific manner in which the selling stockholders will offer and sell these securities and also may add, update or change information contained or incorporated by reference in this prospectus. The names of any underwriters and the specific terms of a plan of distribution, if needed, will be stated in the prospectus supplement.

We will not receive any proceeds from the sale of shares of Class A common stock by the selling stockholders pursuant to this prospectus. However, we will pay certain expenses associated with the sale of securities pursuant to this prospectus, as described in the section titled “Plan of Distribution.”

We are an “emerging growth company” as defined under the federal securities laws and, as such, we have elected to comply with certain reduced reporting requirements for this prospectus and may elect to do so in future filings.

Investing in these securities involves certain risks. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 9 of this prospectus, in any applicable prospectus supplement and in our filings with the Securities and Exchange Commission (the “SEC”) that are incorporated herein by reference.

Neither the SEC nor any state securities commission has approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023