Filed Pursuant to Rule 424(b)(4)

Registration No. 333-264104

|

|

|

|

|

|

PROSPECTUS |

| |

CLASS A COMMON STOCK |

| |

4,500,000 SHARES |

The selling stockholders identified in this prospectus are offering 4,500,000 shares of our

Class A common stock. Our Class A common stock is listed on the New York Stock Exchange (“NYSE”) under the symbol “XPOF.” The last reported sale price of our Class A common stock on the NYSE on April 6, 2022 was $20.61 per

share. We will not receive any proceeds from this offering. Prior to the consummation of this offering, certain of the selling stockholders will exchange LLC Units for shares of our Class A common stock to be sold by them in the offering. See

“Principal and Selling Stockholders,” “Certain Relationships and Related Party Transactions—Amended LLC Agreement” and “Organizational Structure.”

We are an “emerging growth company” as defined under the federal securities laws and, as such, we have elected to comply

with certain reduced reporting requirements for this prospectus and may elect to do so in future filings.

Upon

completion of this offering, we will cease to be a “controlled company” as defined under the NYSE listing rules and, subject to certain transition periods permitted by the NYSE listing rules, we will no longer rely on exemptions from

corporate governance requirements that are available to controlled companies.

Investing in our Class A common

stock involves risks. See “Risk Factors” beginning on page 26 of this prospectus and in the section titled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021.

|

|

|

|

|

|

|

|

|

|

|

| |

|

PER SHARE

|

|

|

|

|

TOTAL

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Public offering price |

|

$ |

20.00 |

|

|

|

|

$ |

90,000,000 |

|

|

|

|

|

| Underwriting

discount(1) |

|

$ |

1.15 |

|

|

|

|

$ |

5,175,000 |

|

|

|

|

|

| Proceeds, before expenses to the selling stockholders |

|

$ |

18.85 |

|

|

|

|

$ |

84,825,000 |

|

(1) See “Underwriting” for additional information regarding underwriter compensation.

The underwriters may also exercise their option to purchase up to an additional 675,000 shares of our Class A Common Stock from

the selling stockholders at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a

criminal offense.

The shares will be ready for delivery on or about April 11, 2022.

|

|

|

|

|

| BofA Securities |

|

|

|

Jefferies |

|

|

Morgan Stanley |

|

|

|

|

|

|

|

|

|

| Guggenheim Securities |

|

Piper Sandler |

|

Baird |

|

Raymond James |

|

|

|

|

|

| Roth Capital Partners |

|

R. Seelaus & Co., LLC |

|

|

|

|

|

|

The date of this prospectus is April 6, 2022. |

|

|

|

|

TABLE OF CONTENTS

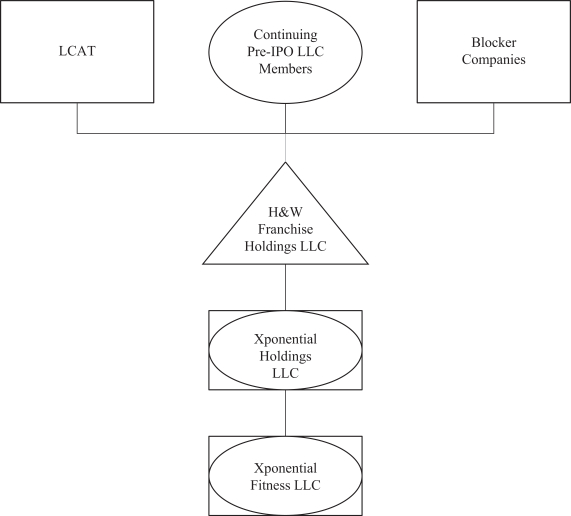

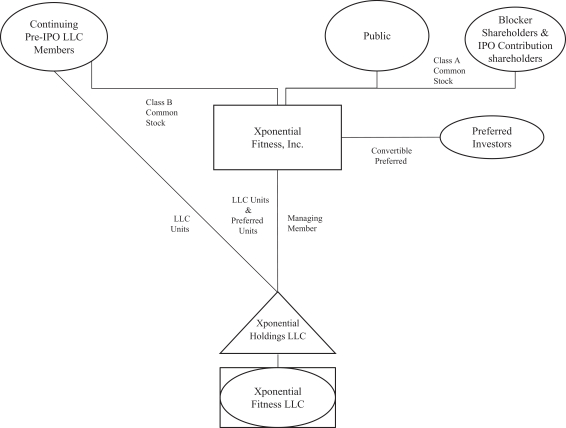

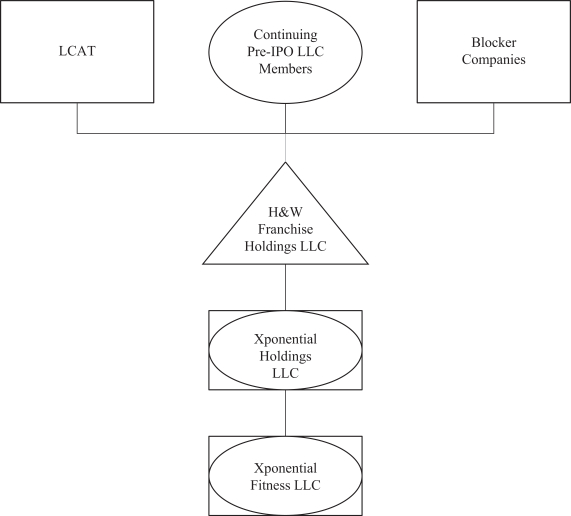

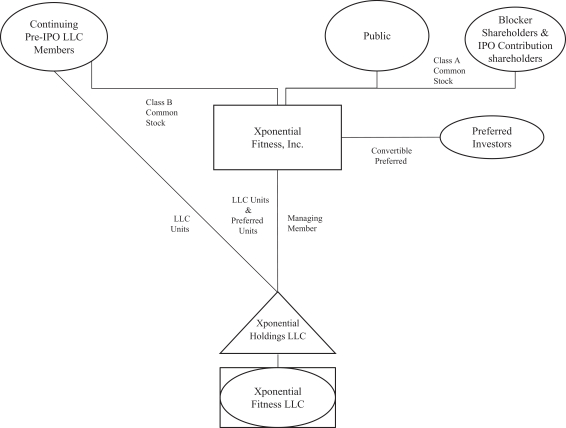

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to “we,” “us,”

“our,” the “company,” “Xponential Fitness,” “Xponential” and similar terms refer to Xponential Fitness, Inc. together with its consolidated subsidiaries, including Xponential Intermediate Holdings, LLC

(“Xponential Holdings LLC”) and Xponential Fitness LLC. We are a holding company and we hold substantially all of our assets and conduct substantially all of our business through Xponential Fitness LLC, a subsidiary of Xponential Holdings

LLC.

We, the selling stockholders and the underwriters have not authorized anyone to provide any information or to make any

representations other than those contained or incorporated by reference in this prospectus or in any free writing prospectuses we have prepared. We, the selling stockholders and the underwriters take no responsibility for, and can provide no

assurance as to the reliability of, any other information that others may provide you. We, the selling stockholders and the underwriters are offering to sell, and seeking offers to buy, shares of our Class A common stock only in jurisdictions

where offers and sales are permitted. The information contained or incorporated by reference in this prospectus is accurate only as of the date of this prospectus or the date of the applicable document incorporated by reference, as applicable,

regardless of the time of delivery of this prospectus or of any sale of our Class A common stock. Our business, financial condition, results of operations and prospects may have changed since such dates.

i

Market and Industry Data

This prospectus and the documents incorporated by reference herein include industry and market data that we obtained from periodic industry

publications, third-party studies and surveys, filings of public companies in our industry, third-party analyses and internal company surveys. These sources include government and industry sources. Industry publications and surveys generally state

that the information contained therein has been obtained from sources believed to be reliable. Although we believe the industry and market data to be reliable as of the date of this prospectus or the date of the applicable document incorporated by

reference, this information could prove to be inaccurate. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits

on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. In addition, we do not know all of the assumptions regarding general economic conditions or growth that were

used in preparing the forecasts from the sources relied upon or cited herein.

The information contained or incorporated by reference in

this prospectus concerning our industry and the market in which we operate, including our general expectations and market position, market opportunity and market size, is based on the information described above, on assumptions that we have made

based on that data and similar sources, third-party analyses by Buxton Company and on our knowledge of the markets for our brands. This information involves a number of assumptions and limitations and is inherently imprecise and you are cautioned

not to give undue weight to these estimates. In addition, the industry in which we operate, as well as the projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate, are subject

to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” herein and in our Annual Report on Form 10-K for the year ended December 31,

2021 (the “2021 Form 10-K”) and elsewhere in this prospectus and the documents incorporated by reference, that could cause results to differ materially from those expressed in these publications and

other sources.

In 2021, we commissioned Buxton Company to provide a whitespace study to analyze the estimated number of studios that

franchisees could optimally have in the United States as of June 30, 2021. The Buxton Company whitespace study leverages performance drivers for each brand including competition, cotenancy, area draw, and detailed customer profiles using

Experian’s Mosaic71 psychographic segmentation system to create a rigorous analysis of trade areas throughout the United States. Whitespace represents a snapshot of our business as of June 30, 2021 and is expected to change as our business

evolves over time.

In 2021, we commissioned Frost & Sullivan to conduct an independent analysis to assess the total addressable

market on the U.S. boutique fitness market. The estimates provided by Frost & Sullivan include the impact of the coronavirus (“COVID-19”) pandemic.

Non-GAAP Financial Measures

This prospectus contains references to adjusted EBITDA and adjusted EBITDA margin, which are financial measures not required by, or presented

in accordance with, generally accepted accounting principles in the United States (“GAAP”). We use adjusted EBITDA and adjusted EBITDA margin when planning, monitoring, and evaluating our performance. We believe that adjusted EBITDA and

adjusted EBITDA margin are appropriate measures of our operating performance because they eliminate the impact of expenses that we do not believe reflect our underlying business performance.

We believe that adjusted EBITDA and adjusted EBITDA margin, viewed in addition to, and not in lieu of, our reported GAAP results, provides

useful information to investors regarding our performance and overall results of operations because it eliminates the impact of other items that we believe reduce the comparability of our underlying core business performance from period to period

and is therefore useful to our investors in

1

comparing the core performance of our business from period to period. In addition, other companies, including companies in our industry, may calculate adjusted EBITDA and adjusted EBITDA margin

differently, which reduces their usefulness as comparative measures. See “Summary Consolidated Financial and Other Data” for the definitions of adjusted EBITDA and adjusted EBITDA margin and a reconciliation of adjusted EBITDA to net loss

and of adjusted EBITDA margin to net loss margin, the most directly comparable financial measures calculated in accordance with GAAP.

Basis of Presentation

Throughout this prospectus and in the documents incorporated by reference herein, we provide a number of key performance indicators used by

management and typically used by our competitors in the franchise industry, including same store sales, system-wide sales and average unit volume (“AUV”). These are operating measures that include sales by franchisees that are not revenue

realized by us in accordance with GAAP. While we do not record sales by franchisees as revenue and such sales are not included in our consolidated financial statements, we believe that these operating measures aid in understanding how we derive our

royalty and marketing revenue and are important in evaluating our performance. Same store sales refers to period-over-period sales comparisons for the base of studios (which we define to include studios in North America that have been open for at

least 13 calendar months as of the measurement date). System-wide sales represent gross sales by all studios in North America, which includes sales by franchisees that are not revenue recognized by us in accordance with GAAP. While we do not record

sales by franchisees as revenue, and such sales are not included in our consolidated financial statements, this operating metric relates to our revenue because our royalty and marketing revenue are calculated based on a percentage of franchised

studio sales. LTM AUV consists of the average sales for the trailing 12 calendar months for all studios in North America that have been open for at least 13 calendar months as of the measurement date. AUV is calculated by dividing sales during the

applicable period for all studios being measured by the number of studios being measured. Quarterly run-rate AUV is calculated as the quarterly AUV multiplied by four, for North American studios that are at

least 6 months old at the beginning of the respective quarter. Monthly run-rate AUV is calculated as the monthly AUV multiplied by twelve, for North American studios that are at least 6 months old at the

beginning of the respective month. AUV and other key performance indicators are discussed in more detail in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Performance Indicators” in our

2021 Form 10-K incorporated by reference in this prospectus.

All key performance indicators,

except adjusted EBITDA, provided throughout this prospectus are presented on an adjusted basis to reflect historical information of brands we acquired in 2017, 2018 and 2021 and therefore include time periods during which certain of our brands were

operated by our predecessors. We acquired Club Pilates Franchise, LLC (“Club Pilates”) and CycleBar Franchising LLC (“CycleBar”) in September 2017, Stretch Lab Franchise, LLC (“StretchLab”) in November 2017, Row House

Franchise, LLC (“Row House”) in December 2017, AKT Franchise LLC (“AKT”) in March 2018, Yoga Six Franchise, LLC (“YogaSix”) in July 2018, PB Franchising, LLC (“Pure Barre”) in October 2018, Stride Franchise,

LLC (“Stride”) in December 2018, Rumble Fitness LLC (“Rumble”) in March 2021 and BFT Franchise Holdings, LLC (“BFT”) in October 2021.

References throughout this prospectus to comparisons to industry competitors are as of December 31, 2021, unless otherwise noted.

References throughout this prospectus to “North America” refer to the United States and Canada and references to

“international” refer to countries other than the United States and Canada.

References throughout this prospectus to the sale

or selling of a license refer to the grant of a right to a third party to access our intellectual property and all other services that we provide under our franchise agreements.

2

References throughout this prospectus to the number of licenses sold in North America and

globally reflect the cumulative number of licenses sold by us (or, outside of North America, by our master franchisees), since inception through the date indicated. Licenses contractually obligated to open refer to licenses sold net of opened

studios and terminations. Licenses contractually obligated to be sold internationally reflect the number of licenses that master franchisees are contractually obligated to sell to franchisees outside of North America under master franchise

agreements.

References throughout this prospectus to an “open” studio refer to any studio that has conducted classes and is

operational, although such studio may have temporarily suspended in-person classes for a period of time due to the COVID-19 pandemic.

3

PROSPECTUS SUMMARY

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus and the documents

incorporated by reference in this prospectus. This summary does not contain all of the information you should consider before investing in our Class A common stock. You should read this entire prospectus carefully, including the information

incorporated by reference in this prospectus, and any free writing prospectus prepared by us or on our behalf, including the section entitled “Risk Factors” in this prospectus, the documents incorporated by reference in this prospectus and

the consolidated financial statements and related notes thereto incorporated by reference in this prospectus, before deciding whether to invest in our Class A common stock.

Xponential Fitness, Inc.

Xponential Fitness is the largest global franchisor of boutique fitness brands. We offer a diversified platform of ten brands spanning across

verticals including Pilates, indoor cycling, barre, stretching, rowing, dancing, boxing, running, functional training and yoga. Our franchisees offer energetic, accessible and personalized workout experiences led by highly qualified instructors in

studio locations across 48 U.S. states, the District of Columbia and Canada and through master franchise or international expansion agreements in ten additional countries. Our portfolio of brands includes Club Pilates, the largest Pilates brand in

the United States; CycleBar, the largest indoor cycling brand in the United States; StretchLab, a concept offering one-on-one and group stretching services; Row House,

the largest franchised indoor rowing brand in the United States; AKT, a dance-based cardio workout combining toning, interval and circuit training; YogaSix, the largest franchised yoga brand in the United States; Pure Barre, a total body

workout that uses the ballet barre to perform small isometric movements, and the largest Barre brand in the United States; Stride, a treadmill-based cardio and strength training concept; Rumble, a boxing-inspired full-body workout; and BFT, a

functional training and strength-based program.

The foundation of our business is built on strong partnerships with franchisees. Our

business model is straightforward: we license our boutique studio operations, share our business processes and branding with franchisees, and in exchange charge royalties and other fees for our services. We are highly focused on providing

franchisees with extensive support to help maximize their performance and enhance their return on investment. In turn, this partnership accelerates our growth and increases our profitability as a result of the royalties we generate on

franchisees’ sales. We encourage our franchisees to follow a membership-based model, which generates recurring, predictable revenues for both us and our franchisees. We believe our unique combination of a scaled multi-brand offering, resilient

franchise model with strong unit economics and integrated platform has enabled us to build our leading market position in the large and growing U.S. boutique fitness industry. We are able to improve our operating leverage as we grow the number of

studios operating under our brand umbrellas, given that our existing infrastructure can scale across a larger system with minimal incremental costs.

4

Our Market Leading Brand Portfolio

|

|

|

|

Largest Pilates brand in the United States, created with the vision to make Pilates more accessible,

approachable, and welcoming to everyone. 693 Studios Open

1,060 Licenses Sold |

|

Largest barre brand in the United States, offers an effective,

low-impact workout for all ages and fitness levels. 612 Studios Open

734 Licenses Sold

|

|

|

|

|

Largest indoor cycling brand in the United States, offering an inclusive

low-impact/high intensity indoor cycling experience for all ages and experience levels. 249

Studios Open 516 Licenses Sold |

|

First to offer 1x1 assisted stretching classes. Highly complementary with

our other brands.

151 Studios Open 570

Licenses Sold |

|

Largest rowing brand in the United States, offering a full body/low impact workout which has revolutionized the

way people view indoor rowing. 91 Studios Open

320 Licenses Sold |

|

Largest franchised yoga brand in the United States, dedicated to the evolution and modernization of yoga.

131 Studios Open 529

Licenses Sold |

|

|

|

|

Boxing-based concept offering a 10-round, high energy cardio workout

split between boxing drills and resistance training. 14 Studios Open

201 Licenses Sold |

|

Dance-based cardio concept combining dance, intervals and

strength training.

28 Studios Open 112

Licenses Sold |

|

Treadmill-based cardio and strength workout, offering coached interval running classes for all fitness

levels. 10 Studios Open

88 Licenses Sold |

|

Community-based 50-minute functional, high-energy strength,

cardio

and conditioning. 151 Studios Open

294 Licenses Sold |

Note: Global studio counts and licenses sold globally as of December 31, 2021.

5

We carefully built the Xponential Fitness brand portfolio through a series of acquisitions,

targeting select health and wellness verticals. In curating our portfolio, we identified brands with exceptional programming and a loyal consumer base which we believed would benefit from our operational expertise, franchising experience and scaled

platform. With over 250 years of collective industry experience, our management team and brand presidents are the driving force behind our operational excellence. We have established a proven operational model (the “Xponential Playbook”)

that helps franchisees generate compelling studio economics. This model has allowed us to provide extensive support to franchisees, particularly during the COVID-19 pandemic. The key pillars of our Xponential

Playbook include:

| |

• |

|

optimizing the studio prototype and investment cost; |

| |

• |

|

thoroughly vetting franchisee candidates; |

| |

• |

|

real estate identification, site selection, studio build-out and

design assistance; |

| |

• |

|

comprehensive pre-opening support, including membership sales,

marketing support, employee training and programming development; |

| |

• |

|

detailed studio-level operational framework and best practices; |

| |

• |

|

intensive instructor and studio-level management training; |

| |

• |

|

our robust digital platform and XPASS offerings that allow franchisees to generate incremental revenue;

|

| |

• |

|

data-driven analytical tools to support marketing strategies, member acquisition and retention;

|

| |

• |

|

sophisticated technology systems, including uniform point-of-sale and reporting systems, to drive studio-level performance; |

| |

• |

|

centralized model capable of providing resources to franchisees in the event of exceptional crises, such as

the COVID-19 pandemic; and |

| |

• |

|

ongoing monitoring and support to promote success. |

The Xponential Playbook is designed to help franchisees achieve compelling Average Unit Volumes (“AUVs”), strong operating margins

and an attractive return on their invested capital. Studios are generally designed to be between 1,500 and 2,500 square feet in size, depending on the brand. The smaller box format contributed to a relatively low average initial franchisee

investment of approximately $350,000 in 2021 and 2020. By utilizing the Xponential Playbook, our model is designed to generate, on average, an AUV of approximately $500,000 in year two of operations and studio-level operating margins ranging between

25% and 30%, resulting in an unlevered cash-on-cash return of approximately 40%.

We believe our integrated, centralized platform is a unique competitive advantage in the boutique fitness industry and enables us to

accelerate growth and enhance operating margins. Our multi-brand offering results in higher franchisee lead flow and conversion, which lowers franchisee acquisition costs. Existing franchisees also serve as an embedded pipeline for continued

expansion across our brands. As a result of our scale, we benefit from greater access to real estate and favorable vendor relationships. Additionally, we leverage shared corporate services across franchise sales, real estate, supply chain,

merchandising, information technology, finance, accounting and legal. As an integrated platform, we utilize technology to provide improved functionality, drive

6

efficiency and access compelling data across our brands. Our robust XPLUS digital platform, which features digital workout content from across our brands, as well as our cross-brand XPASS

subscription offering, are important examples of our ability to cross-sell our individual brands, offering members variety and flexibility to work out both in-studio and

at-home, across modalities and geographies, thereby driving increased member interest and retention. We also benefit from knowledge sharing and best practices across the portfolio. We believe that we are in

the early stages of unlocking the power of our platform and driving long-term growth.

As a franchisor, we benefit from multiple highly

predictable and recurring revenue streams that enable us to scale our franchised studio base in a capital efficient manner. Our system has significant embedded growth based on already-sold licenses for studios that have not yet opened. As of

December 31, 2021, franchisees were contractually obligated to open an additional 1,806 studios in North America. Converting our current pipeline of licenses sold to open studios in North America would nearly double our existing franchised

studio base. Based on our internal and third-party analyses by Buxton Company, we estimate that franchisees could have a total of approximately 7,900 studios in the United States alone.

Internationally, we partner with experienced master franchisees to deploy an asset light global expansion strategy. As of December 31,

2021, master franchisees were contractually obligated to sell licenses to franchisees to open an additional 956 studios in ten countries internationally pursuant to master franchisee agreements (“MFAs”). As part of the acquisition of BFT,

we entered into an MFA with the sellers of BFT. As of December 31, 2021, there were 149 open BFT studios in Australia, New Zealand and Singapore, and an additional 140 licenses sold.

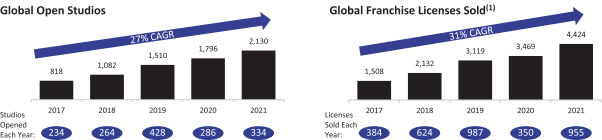

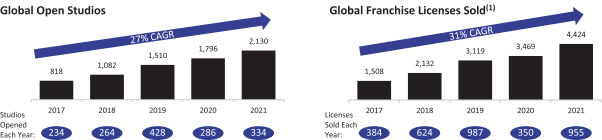

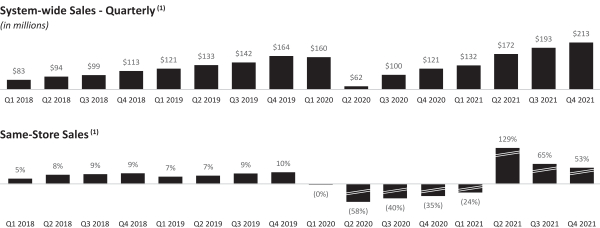

Highlights of our platform’s recent financial results and growth include:

| |

• |

|

grew the number of global open studios from 1,796 as of December 31, 2020 to 2,130 as of December 31,

2021, representing an increase of 19%; |

| |

• |

|

grew global franchise licenses sold from 3,469 as of December 31, 2020 to 4,424 as of December 31,

2021, representing an increase of 28%; |

| |

• |

|

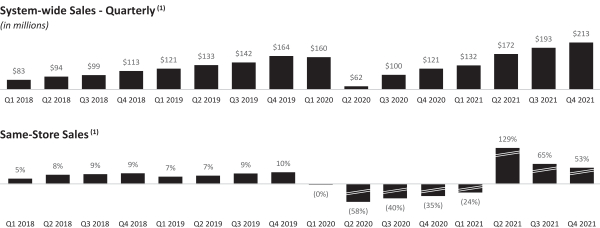

grew system-wide sales from $443 million in 2020 to $710 million in 2021, representing an increase of

60%; |

| |

• |

|

grew same store sales from a decline of 34% in 2020 to positive 41% in 2021, which reflects a significant rebound

of studio performance following the impact of the COVID-19 pandemic; |

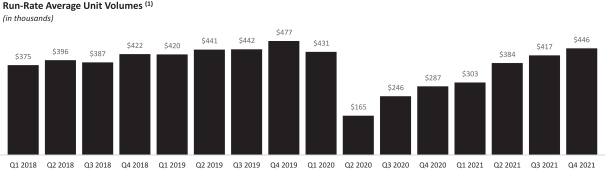

| |

• |

|

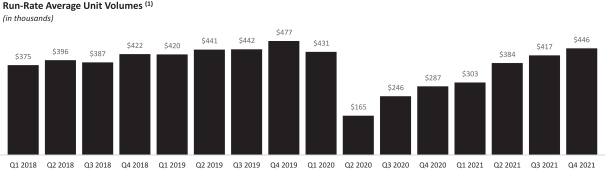

grew run-rate AUV from $287,000 in the fourth quarter of 2020 to $446,000

in the fourth quarter of 2021, representing an increase of 55%; and |

| |

• |

|

acquired certain assets and rights to two additional brands in 2021, Rumble and BFT. |

All metrics above are presented on an adjusted basis to reflect historical information of the brands we acquired and therefore include time

periods during which certain of the brands were operated by our predecessors. We acquired Club Pilates and CycleBar in September 2017, StretchLab in November 2017, Row House in December 2017, AKT in March 2018, YogaSix in July 2018, Pure Barre in

October 2018, Stride in December 2018, Rumble in March 2021 and BFT in October 2021.

As a result of the

COVID-19 pandemic, our operations and the businesses of our franchisees were adversely affected beginning in March 2020 continuing through the remainder of 2020. With a majority of our studios closed in March

and April of 2020, we were focused on re-directing our members and franchisees to our digital platform, thus helping our franchisees retain members and providing a tool for franchisees to preserve

7

member relationships and generate revenue. As restrictions on indoor fitness classes were reduced in later 2020, franchisees’ in-studio operations

began to recover. The adverse effects of the COVID-19 pandemic continued to abate through 2021, as vaccination rates in the United States increased substantially and restrictions were further reduced or

eliminated in most states. As of December 31, 2021, we have seen our system surpass pre-COVID levels, with our franchisees’ member base 29% larger than it was as of December 31, 2019. With many consumers increasingly health conscious

and either returning to their fitness communities or forming new fitness habits, we have experienced significant growth in the aftermath of the pandemic.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year ended December 31, 2021 |

|

|

|

|

|

Year ended December 31, 2020 |

|

| |

|

North

America |

|

|

International |

|

|

Global |

|

|

|

|

|

North

America |

|

|

International |

|

|

Global |

|

| Open Studios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Open Studios (beginning of period) |

|

|

1,714 |

|

|

|

82 |

|

|

|

1,796 |

|

|

|

|

|

|

|

1,472 |

|

|

|

38 |

|

|

|

1,510 |

|

| New Studio Openings |

|

|

240 |

|

|

|

94 |

|

|

|

334 |

|

|

|

|

|

|

|

242 |

|

|

|

44 |

|

|

|

286 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Open Studios (end of period) |

|

|

1,954 |

|

|

|

176 |

|

|

|

2,130 |

|

|

|

|

|

|

|

1,714 |

|

|

|

82 |

|

|

|

1,796 |

|

|

|

|

|

|

|

|

|

| Franchise Licenses Sold

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Franchise Licences Sold (total beginning of period) |

|

|

3,275 |

|

|

|

194 |

|

|

|

3,469 |

|

|

|

|

|

|

|

3,010 |

|

|

|

109 |

|

|

|

3,119 |

|

| New Franchise License Sales |

|

|

787 |

|

|

|

168 |

|

|

|

955 |

|

|

|

|

|

|

|

265 |

|

|

|

85 |

|

|

|

350 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Franchise Licences Sold (total end of period) |

|

|

4,062 |

|

|

|

362 |

|

|

|

4,424 |

|

|

|

|

|

|

|

3,275 |

|

|

|

194 |

|

|

|

3,469 |

|

|

|

|

|

|

|

|

| Studios Obligated to Open Internationally under MFA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Studios Obligated to Open under MFA |

|

|

|

|

|

|

|

|

|

|

1,132 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

768 |

|

| Less: Studios Opened under MFA |

|

|

|

|

|

|

|

|

|

|

176 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

82 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Remaining Studios Obligated to Open under MFA |

|

|

|

|

|

|

|

|

|

|

956 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

686 |

|

| Licenses Already Sold by Master

Franchisees(2)(3) |

|

|

|

|

|

|

|

|

|

|

184 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

110 |

|

| (1) |

Global Franchise Licenses Sold are presented gross of terminations. |

| (2) |

Net of two international license terminations. |

| (3) |

Reflects the number of licenses for studios which have already been sold, but not yet opened, by master

franchisees under MFAs. |

8

| (1) |

Represents North American Studios. |

| (1) |

Represents run-rate AUVs for North American studios open for 6+ months. |

Note: The above data is presented on an adjusted basis to reflect historical information of the brands we acquired and therefore includes time periods during

which certain of the brands were operated by our predecessors. We acquired Club Pilates and CycleBar in September 2017, Stretch Lab in November 2017, Row House in December 2017, AKT in March 2018, Yoga Six in July 2018, Pure Barre in October 2018,

Stride in December 2018, Rumble in March 2021 and BFT in October 2021.

Our Industry

We operate in the large and growing boutique fitness segment of the broader health and fitness club industry. Boutique fitness encompasses a

social, supportive community of coaches and consumers engaging through class-based programming in small studio spaces (typically 1,500-2,500 square feet). A boutique fitness workout typically offers more

customized programming and a more intensive experience complemented by increased levels of personal attention and guidance relative to a traditional health and fitness club. The U.S. boutique fitness market was estimated at $21.1 billion in

2019, according to an independent analysis we had commissioned from Frost & Sullivan. International Health, Racquet & Sportsclub Association (“IHRSA”) estimates that boutique fitness memberships grew more rapidly than the

overall health and fitness club memberships between 2015 and 2019, with target boutique fitness consumers spending more and engaging more frequently than the average health and fitness club member in 2019.

In 2019, IHRSA estimated the size of the global health and fitness club industry at $96.7 billion, with more than 205,000 clubs serving

over 184 million members in 2019. Prior to the COVID-19 pandemic, the U.S. health and fitness club industry experienced annual growth for more than 21 consecutive years. As a result of the

9

COVID-19 pandemic, the industry saw unprecedented declines in 2020 and 2021, with 2020 U.S. health and fitness club revenue declining by 58%, according to

IHRSA. As of January 1, 2022, 30% of boutique fitness studios had closed permanently, according to IHRSA, which we believe presents an opportunity for Xponential to further penetrate new and existing markets, capturing displaced fitness

consumers.

As the largest franchisor in the boutique fitness industry, we saw continued strong growth during the COVID-19 pandemic. We opened 555 new studios globally between April 2020 and December 2021, including studios opened by Rumble and BFT. As of December 31, 2021, we have seen our system surpass pre-COVID levels,

with our franchisees’ member base 29% larger than it was as of December 31, 2019.

As

COVID-19 pandemic restrictions ease, we believe pent-up demand for in-person fitness will spur a return to studios and gyms,

propelling growth across the industry. IBISWorld estimates that the U.S. gym, health and fitness club industry will reach $36.6 billion in 2022. Frost & Sullivan estimates that the total addressable U.S. boutique fitness market will

reach $22.1 billion in 2022 and will grow at a CAGR of approximately 5.8% between 2022 and 2025. According to IHRSA, approximately 95% of fitness consumers surveyed miss at least one aspect of physically being at their studio or gym, and 94%

plan to return to the gym in some capacity. Consumers’ desire to return to their fitness communities and their increasing prioritization of healthy lifestyles has driven consistent growth in our franchisees’ membership base, with actively

paying members and visitation rates increasing 70% and 50%, respectively, in the three months ended December 31, 2021 relative to the three months ended December 31, 2020.

Our Competitive Strengths

Diversified

portfolio of leading boutique fitness brands.

Our portfolio of ten diversified brands spans a variety of popular fitness and wellness

verticals including Pilates, barre, cycling, stretching, rowing, yoga, boxing, dancing, running and functional training. We believe that our diversification represents a significant competitive advantage in a fragmented market comprised primarily of

single-brand companies focused on an individual fitness or wellness vertical. The complementary nature of our brands allows our franchised studios to be located in close proximity to one another, providing variety and convenience to both consumers

and franchisees. Our brands appeal to a broad range of consumers across ages, fitness levels and demographics and are positioned at accessible price points. The strength of our brands is highlighted by the numerous accolades they have received, with

four brands (Club Pilates, Pure Barre, CycleBar and StretchLab) each being listed among Entrepreneur’s 2022 Franchise 500 rankings and BFT being voted the 2020 APAC Franchise of the Year. We believe that our diversified brand offering expands

our total addressable market and translates into increased use occasions for consumers, driving increased share of wallet and enhancing consumer lifetime value across our portfolio.

Market leading position with significant nationwide scale.

We are the largest global boutique fitness franchisor with over 1,900 studios operating across ten brands in the United States alone. Our

three largest brands have leading market share positions within their respective verticals. These brands, Club Pilates, Pure Barre and CycleBar, were approximately nine, four and three times larger than their next largest competitors, respectively,

as of December 31, 2021. As the leader in these verticals, and as one of few players of scale, we believe that we occupy an advantageous position in an otherwise highly fragmented boutique fitness market.

We are able to leverage the popularity and reputation of existing Xponential studios to support both new studio sales to franchisees and to

support franchisees’ ability to attract new customers to their studios. We believe that the continued expansion of the Xponential platform creates a network effect that reinforces our competitive

10

position, making us increasingly attractive to potential franchisees and making studios increasingly popular with boutique fitness consumers. In conjunction with our scale, we have been able to

achieve broad geographic diversification across the United States with studios in 48 states, the District of Columbia and Canada as of December 31, 2021. According to Buxton Company, over 62% of the U.S. population (excluding Alaska and Hawaii)

lives within 10 miles of an Xponential studio location. Our geographic reach represents a material competitive advantage, as we have demonstrated success across various markets, and we are able to remain competitive nationally when extraordinary

events heavily impact specific markets.

Passionate, growing and loyal consumer base.

Our franchised studios provide differentiated and accessible boutique fitness experiences that are fun, energetic and deliver a strong sense

of community, engendering loyalty and engagement with consumers. Our brands serve a broad demographic; our consumer skews female and is typically between the ages of 20 and 60 years old, holds at least a bachelor’s degree and reports

household income greater than $75,000 per year. Across our system, more than 1.3 million unique consumers completed nearly 30 million in-studio, live stream and virtual workouts in 2021 and more than

850,000 unique consumers completed nearly 20 million in-studio, live stream and virtual workouts in 2020. As of December 31, 2021, studios had nearly 450,000 members, of which over 390,000 were actively paying members on recurring membership

packages (excludes Rumble and BFT). The number of total members at studios as of December 31, 2021 represented an increase of 49% and 29% compared to the number of total members at studios as of December 31, 2020 and 2019, respectively.

The loyalty of our consumer base is evidenced by our franchisees’ ability to recover to approximately 113% of actively paying members as of December 31, 2021, relative to December 31, 2019 levels and membership visits for the quarter

ended December 31, 2021 were at 117% relative to the quarter ended December 31, 2019 levels (excludes Rumble and BFT). For the quarter ended December 31, 2021, run-rate AUVs recovered to

approximately 94% relative to the quarter ended December 31, 2019 (includes Rumble and BFT). Our franchised studios foster consumer engagement, personal accountability to achieve fitness goals and a strong sense of community, which drive repeat

visits and maximize consumer lifetime value.

We believe that we were able to deepen our consumer loyalty during the COVID-19 pandemic through our robust digital platform offering, as well as the personal efforts of exceptional franchisees to strengthen their studio communities. As of December 31, 2021, we had over 55,000

total users on our digital platform, XPLUS, and we offered over 2,800 digital workouts in our content library. Approximately 90% of class bookings were done through the Xponential brand app in the 90 days ending December 31, 2021.

In addition, we continually seek ways to further heighten the Xponential consumer experience. For example, we launched a partnership with

Apple in March 2021 that features Apple Watch integration across all of our popular fitness and wellness verticals, excluding BFT, and is designed to increase consumer engagement and retention across our franchised studios.

Xponential Playbook supports system-wide operational excellence.

We strategically partner with franchisees who have been vetted by a thorough selection process. Through the Xponential Playbook, we provide

franchisees with significant support from the outset, focused on delivering a superior experience and maximizing studio-level productivity and profitability. Franchisees also benefit from the significant investments we have made in our corporate

platform, through which we leverage integrated systems and shared services. While marketing and fitness programming are specific to each brand, nearly all other franchisee support functions are integrated across brands at the corporate level, and

franchisees are guided through the key pillars of successful studio operations. We believe the relationships we maintain with franchisees drive tangible results for consumers: well-managed boutique fitness studios; access to technology capabilities;

retention of highly qualified instructors; and a consistent, community-based experience across

11

brands and geographies. We believe the extensive level of support we provide to franchisees is a key driver of system-wide operational excellence.

Asset-light franchise model and predictable revenue streams that support free cash flow conversion.

We believe our asset-light franchise model drives faster system-wide unit growth, compared to a similarly capitalized corporate-owned model.

As a franchisor, we have multiple highly predictable revenue streams and low ongoing capital requirements. Upon the granting of access to a license, we receive a one-time,

non-refundable upfront payment from franchisees for the right to open a studio in a specific territory. This is followed by a series of contractual payments once a studio is open, many of which are recurring,

including royalty fees, technology fees, merchandise sales, marketing fees and instructor and management training revenues. More than 75% and 73% of our revenue in 2021 and 2020, respectively, was considered recurring, and we believe this percentage

will increase as franchise royalty fees are expected to account for a greater percentage of our revenue over time.

Highly attractive and predictable

studio-level economics.

The Xponential Playbook is designed to help franchisees achieve compelling AUVs, strong operating margins and

an attractive return on their invested capital. Studios are generally designed to be between 1,500 and 2,500 square feet in size, depending on the brand, which contributed to a relatively low average initial franchisee investment of approximately

$350,000 in 2021 and 2020. Our model is generally designed to generate, on average under normal conditions, an AUV of $500,000 in year two of operations and studio-level operating margins ranging between 25% and 30%, resulting in an unlevered cash-on-cash return of approximately 40%. A studio reaches “base maturity” when it has annualized monthly revenues in the $400,000 to $600,000 AUV range. Using our

model, we expect this to typically occur 6-12 months after studio opening. We believe that studios typically have opportunity to continue growing and maturing beyond that point, however.

We believe the continued growth of the franchisee system reflects the attractiveness of our unit economic model. In 2021, 252 new franchisees

joined our system in North America, representing a 91% increase year-over-year. In 2020, we were able to attract 132 new franchisees in North America despite the material challenges faced by the overall fitness industry as a result of the COVID-19 pandemic. Additionally, franchisees frequently re-invest into our system, as 33% and 36% of new studios in 2021 and 2020, respectively, were opened by existing

franchisees. We believe our strong studio-level economics have contributed to our growth.

Large and expanding franchisee base with visible organic

growth.

Our large number of existing licenses sold represents an embedded pipeline to support the continued growth of our business.

As of December 31, 2021, on a cumulative basis since inception, we had 4,424 franchise licenses sold globally, compared to 1,508 franchise licenses sold as of December 31, 2017, on an adjusted basis to reflect historical information of the

brands we have acquired. Franchisees are contractually obligated to open studios in their territories after purchasing a franchise license. In the event that franchisees are unable to meet their contractual obligations, we have the ability to resell

or reassign their territory license(s) to another franchisee in the system or our franchisee pipeline. Based on our experience as a franchisor, we believe that a significant majority of our licenses sold will convert into operating studios.

Accordingly, we have the potential to substantially increase our studio base through our existing licenses sold, providing us high visibility into our unit growth and further increasing our already significant scale within the boutique fitness

industry.

Proven and experienced management team with an entrepreneurial culture.

Our strategic vision and entrepreneurial culture are driven by our highly experienced management team, led by our Chief Executive Officer and

founder, Anthony Geisler. Mr. Geisler has direct experience scaling

12

franchised fitness brands, having previously served as the Chief Executive Officer of LA Boxing, and has worked with many members of our leadership team for several years. Our Brand Presidents

are key members of our leadership team and act as the driving force behind their respective brands. Collectively, our management team fosters an entrepreneurial culture and mentality that resonate with franchisees. The strength of our management

team is illustrated by the growth of the business and the recent honors that we and our brands have received, with four brands (Club Pilates, Pure Barre, CycleBar and StretchLab) each being listed among Entrepreneur’s 2022 Franchise 500

rankings. Our leadership team has significant experience scaling franchised fitness brands and has created a culture designed to enable our future success.

Our Growth Strategies

We

believe we are well-positioned to capitalize on multiple opportunities to drive the long-term growth of our business:

Grow our franchised studio base

across all brands in North America.

We have the opportunity to meaningfully expand our franchised studio footprint in North America

by leveraging our multiple brands and verticals, as well as our proven portability across regions and demographics.

We have grown our

franchised studio footprint in North America from 813 open studios across 47 U.S. states, the District of Columbia and Canada as of December 31, 2017 to 1,954 open studios across 48 U.S. states, the District of Columbia and Canada as of

December 31, 2021, on an adjusted basis to reflect historical information of the brands we have acquired, representing a CAGR of 25%. As of December 31, 2021, we had 1,556 franchisees and licenses for 1,806 studios contractually obligated

to be opened under existing franchise agreements in North America. We sold 787 licenses in 2021 compared to 265 licenses in 2020 and 923 licenses in 2019 in North America. While we experienced delays in new studio openings in 2020 and 2021 due to

the COVID-19 pandemic, we have continued opening studios throughout the COVID-19 pandemic and franchisees have opened 426 studios in North America from April 2020

through December 2021. Our track-record of successful expansion demonstrates that the experience and value offered by our brands resonate with consumers across geographies, including urban and suburban markets, ages and income levels. Our small box

format and multi-brand model have enabled us to scale rapidly, as franchisees have the ability to open studios across multiple brands adjacent or in close proximity to each other, creating cross-selling opportunities and providing consumers with

greater optionality. As we scale, we expect to attract multi-studio franchisees to help us accelerate our pace of growth. Based on our internal and third-party analyses by Buxton Company, franchisees could have a total of approximately 6,900 studios

in the United States alone, prior to the acquisition of BFT. While no formal analysis has been conducted to assess the incremental studio opportunity attributable to BFT, Buxton expects that the addition of BFT will add approximately 1,000 more

independent studio opportunities to our United States whitespace provided that we and BFT continue to operate in a manner consistent with the rest of our brands. This estimate represents the number of potential studio locations in the United States

that exists in 2021 based on the criteria we consider for franchise license locations, such as customer profiles, trade area analyses and brand performance. Franchisees provide the capital to open each studio location and we provide ongoing support.

We also continue to grow our presence in North America through strategic brand partnerships. In November 2021, we entered into a Master

Facility Development Agreement with the operators of the LA Fitness and City Sports Club Brands. This partnership allows us the exclusive rights to grant franchise licenses to franchisees within LA Fitness and City Sports Club’s 500 locations.

We’ve committed to offering 350 franchise licenses within LA Fitness and City Sports Club locations over the next five years. Development is already underway, with the first few locations having opened in early 2022.

13

Drive system-wide same store sales and grow AUV.

We believe we can help franchisees grow same store sales and AUVs by acquiring new consumers, increasing membership penetration, driving

increased spend from consumers and expanding ancillary revenue streams through our franchised studios.

| |

• |

|

Acquiring new consumers: We expect to grow our consumer reach through a variety of targeted marketing

campaigns at both the brand and franchisee levels to increase brand awareness and drive studio traffic. |

| |

• |

|

Increasing membership penetration: We expect franchisees to convert new and occasional consumers into

committed, long-term members by delivering consistent, effective workout experiences across our franchised studios. We intend to continue to utilize insights from our consumer management dashboard to refine our sales strategy and offer a variety of

flexible membership options to attract consumers at different engagement levels and price points, including our existing four, eight and unlimited classes per month recurring membership options. Excluding StretchLab, the average price per class for

the consumer ranges from $12 to $25. |

| |

• |

|

Driving increased spend from consumers: We expect to increase spend from consumers by utilizing dynamic

pricing tiers across markets and brands, up-tiering memberships, cross-selling memberships across our brands, driving further digital penetration and enhancing our membership engagement. We work closely with

franchisees to optimize membership offerings based on local consumer demand, demographics and other market factors in order to maximize our share of wallet. |

| |

• |

|

Utilize XPASS to enhance consumer experience and engagement and more effectively cross-sell our brands: We

implemented XPASS in 2021, a membership option that offers our consumers access to multiple brands across the Xponential portfolio under a single monthly membership. XPASS works through a tiered pricing system where consumers pay a given amount for

a set number of points. We believe that XPASS will enable us to continue to attract and retain consumers that are seeking greater variety in their boutique workouts and that we are able to leverage XPASS to introduce consumers to new brands and

verticals within our platform. XPASS offers five monthly subscription options designed to suit different consumer preferences. Subscription plans range from $19 to $249 to enjoy between 1 and 20 classes per month. The most popular subscription plan

is $99 to enjoy up to seven classes per month. XPASS is designed to optimize inventory for classes at our franchisees’ studios through dynamic pricing and assisting in filling open spaces in classes. Franchisees receive approximately 70% of the

subscription fee from XPASS and we receive 30% of the subscription fee. XPASS currently includes all brands other than BFT. |

| |

• |

|

Attract and retain consumers through our XPLUS digital platform: We believe there is an opportunity to

further capitalize on growing consumer demand for digital and at-home fitness solutions by enhancing system-wide capabilities that complement our in-studio offerings.

Our digital platform consists of a library of branded content that we make available to our consumers across our online and mobile platforms for a monthly fee of $19 for individual brand access and $29 for access to all brands. As of

December 31, 2021, we had over 55,000 total users on our digital platform, XPLUS, and we offered over 2,800 digital workouts in our content library. In addition to increasing engagement and retention with our existing in-studio members, our digital platform programs enable us and franchisees to reach new consumers and generate incremental revenues without increasing overhead costs. This enables our brands to deliver high-quality

fitness content and maintain strong levels of member engagement, even when studios are closed. Our proprietary mobile app also allows us to control the user experience. Over 90% of class bookings in studios

|

14

| |

were done via our proprietary mobile app in the 90 days ending December 31, 2021. Using the experience, knowledge and data we gathered in 2021 and 2020, we are planning to further enhance

our production studio, increase production talent and upgrade our content to more closely resemble the in-studio experience at home, so members can experience our brands at any time. Our digital platform

offering currently includes all brands other than BFT. Our new XPLUS digital platform is expected to significantly enhance our member experience and further increase our brands’ reach, accessibility and subscriber engagement.

|

| |

• |

|

Expanding additional revenue streams within our franchised studios: We believe we have the opportunity to

increase consumer spending at our franchised studios by expanding our offering of branded and third-party retail products across apparel and other health and wellness categories. During government-mandated studio closures due to the COVID-19 pandemic, franchisees were able to generate revenue in part through retail sales, including the sale of at-home fitness equipment such as exercise balls and weights.

We expect that franchisees will be able to continue to leverage this revenue stream in the future as some consumers may continue to make at-home fitness a complementary component of their health and wellness

regimens. |

Expand operating margins.

We have built our franchised boutique fitness platform across verticals through a series of acquisitions, investments in our brands, corporate

infrastructure and leadership team. We expect to realize improved operating leverage and increase operating margins over time as we continue to expand our franchised studio base and leverage our shared services and platform. Additionally, we expect

royalties to become a greater percentage of our revenue mix as we continue to open new studios over time. Royalties represent a high margin revenue stream, and we expect an increase in royalties as a percentage of sales to lead to increased

operating margins. We have demonstrated our ability to expand our adjusted EBITDA margin, growing margins from 12.8% in 2019 to 17.6% in 2021. Our business model provides us with highly predictable and recurring revenue streams, attractive margins

and minimal capital requirements, resulting in the ability to invest in future growth initiatives.

Grow our brands and studio footprint

internationally.

We believe there is significant opportunity for further international growth, underscored by our track-record of

successful expansion across a diverse array of North American markets and our recent expansion into multiple international markets, including the 2021 acquisition of BFT.

We are focused on expanding into territories with attractive demographics, including household income, level of education and fitness

participation. We have developed strong relationships and executed master franchise agreements with master franchisees to propel our international growth. These master franchise agreements obligate master franchisees to arrange the sale of licenses

to franchisees in one or more countries outside North America. As of December 31, 2021, we had 176 studios open internationally across Australia, New Zealand, Singapore, Saudi Arabia, Japan, Spain, the Dominican Republic and South Korea. Master

franchisees were contractually obligated to sell licenses to franchisees to open an additional 956 studios in ten countries, of which master franchisees have sold 184 licenses for studios not yet opened as of December 31, 2021.

15

Risk Factors

Our business is subject to a number of risks and uncertainties that you should understand before making an investment decision. These risks

are discussed more fully in the section titled “Risk Factors” in this prospectus and the section titled “Risk Factors” in our 2021 Form 10-K, which is incorporated by reference in this

prospectus and include:

| • |

|

Our business and results of operations were impacted by the ongoing

COVID-19 pandemic. |

| • |

|

Shifts in consumer behavior may materially adversely impact our business. |

| • |

|

We have a limited operating history. |

| • |

|

Our financial results are affected by financial results of master franchisees and franchisees.

|

| • |

|

We may not be able to successfully implement our growth strategy. |

| • |

|

The number of new studios that actually open in the future may differ materially from the number of studio

licenses sold to potential, existing and new franchisees. |

| • |

|

Our success depends substantially on our ability to maintain the value and reputation of our brands.

|

| • |

|

Our expansion into new markets may present increased risks due to our unfamiliarity with those markets.

|

| • |

|

Our expansion into international markets exposes us to a number of risks. |

| • |

|

We have incurred operating losses in the past and may not achieve or maintain profitability in the future.

|

| • |

|

If we or master franchisees fail to identify, recruit and contract with a sufficient number of qualified

franchisees, our ability to open new studios could be materially adversely affected. |

| • |

|

Franchisees may incur rising costs related to the construction of new studios. |

| • |

|

Franchisees may not be able to identify and secure suitable sites for new studios. |

| • |

|

Opening new studios in close proximity to existing studios may negatively impact existing studios’ revenue

and profitability. |

| • |

|

New brands or services that we launch in the future may not be as successful as we anticipate.

|

| • |

|

Franchisees could take actions that harm our business. |

| • |

|

Franchisees may not successfully execute our suggested best practices, which could harm our business.

|

| • |

|

Our investments in underperforming studios may be unsuccessful. |

| • |

|

Disruptions in the availability of financing for current or prospective franchisees could adversely affect our

business, results of operations, cash flows and financial condition. |

| • |

|

Franchisees may be unable to attract and retain customers. |

| • |

|

We may not be able to anticipate and satisfy consumer preferences and shifting views of health and fitness.

|

| • |

|

Our planned growth could place strains on our management, employees, information systems and internal controls,

which may adversely impact our business. |

| • |

|

Our business is subject to various laws and regulations and changes in such laws and regulations.

|

| • |

|

We currently are, and may in the future be, subject to legal proceedings, regulatory disputes and governmental

inquiries. |

| • |

|

We, master franchisees and franchisees could be subject to claims related to health and safety risks to customers

that arise while at our and franchisees’ studios. |

| • |

|

We rely heavily on information systems provided by a single provider. |

| • |

|

If we, master franchisees, franchisees or ClubReady fail to properly maintain the confidentiality and integrity

of our customer personal data, we can be subject to costly litigation and damaged reputation. |

| • |

|

Failure by us, master franchisees, franchisees or third-party service providers to comply with existing or future

data privacy laws and regulations could have a material adverse effect on our business. |

| • |

|

Changes in legislation or requirements related to electronic funds transfer may adversely impact our business

operations. |

| • |

|

We and franchisees are subject to risks related to Automated Clearing House, credit card, debit card and gift

card payments we accept. |

| • |

|

We depend on a limited number of suppliers for certain equipment, services and products. |

| • |

|

Our intellectual property rights, including trademarks and trade names, may be infringed, misappropriated or

challenged by others. |

16

| • |

|

We may not be able to secure music licenses or to comply with the terms and conditions of such licenses, which

may lead to third-party claims or lawsuits against us and/or franchisees. |

| • |

|

Our quarterly results of operations and other operating metrics may fluctuate from quarter to quarter.

|

| • |

|

Use of social media may adversely impact our reputation or subject us to fines or other penalties.

|

| • |

|

We may require additional capital to support business growth and objectives. |

| • |

|

We may engage in merger and acquisition activities, which could require significant management attention, disrupt

our business, dilute stockholder value and adversely affect our results of operations. |

| • |

|

Our retail products may be unacceptable to us or franchisees’ customers. |

| • |

|

Failure to comply with anti-corruption and anti-money laundering laws or similar laws and regulations could

subject us to penalties and other adverse consequences. |

| • |

|

If our estimates or judgments relating to our critical accounting policies prove to be incorrect, our results of

operations could be adversely affected. |

| • |

|

Goodwill and indefinite-lived intangible assets are a material component of our balance sheet and impairments of

these assets could have a significant impact on our results. |

| • |

|

Franchisees may be unable to obtain forgiveness of Paycheck Protection Plan loans under the CARES Act.

|

| • |

|

Our substantial indebtedness could adversely affect our financial condition and limit our ability to pursue our

growth strategy. |

| • |

|

Our failure to satisfy the covenants in our credit agreement may result in events of default.

|

| • |

|

Restrictions imposed by our outstanding indebtedness and any future indebtedness may limit our ability to operate

our business and to finance our future operations. |

| • |

|

We may not be able to maintain required regulatory licenses and permits. |

| • |

|

Unanticipated changes in effective tax rates or adverse outcomes resulting from examination of our income or

other tax returns could adversely affect our results of operations and financial condition. |

| • |

|

The terms of our convertible preferred stock have provisions that could result in a change of control of our

board of directors in the case of an event of default by us. |

| • |

|

Our convertible preferred stock impacts our ability to pay dividends on our Class A common stock and imposes

certain negative covenants on us. |

| • |

|

Our convertible preferred stock ranks senior to our Class A common stock. |

| • |

|

We are a holding company, and depend upon distributions from our subsidiary, Xponential Holdings LLC, to pay

dividends, if any, and taxes, make payments under the TRA and pay other expenses. |

| • |

|

In certain circumstances, Xponential Holdings LLC will be required to make substantial distributions to us and

the other holders of limited liability company units. |

| • |

|

Upon completion of this offering, we will cease to be a controlled company within the meaning of the NYSE listing

rules and accordingly, we will, subject to certain transition periods permitted by the NYSE listing rules, no longer be able to rely on exemptions from corporate governance requirements that are available to controlled companies.

|

| • |

|

Our directors, executive officers and the entities affiliated with our directors and executive officers control a

substantial percentage of our voting capital stock, and their interests may conflict with ours or yours in the future. |

| • |

|

We will be required to pay the TRA parties for certain tax benefits we may receive, and the amounts we may pay

could be significant. |

| • |

|

Our major stockholders may pursue corporate opportunities that could present conflicts with our and our minority

stockholders’ interests. |

| • |

|

We are an “emerging growth company” and we cannot be certain if the reduced disclosure requirements

applicable to emerging growth companies will make our Class A common stock less attractive to investors. |

| • |

|

Failure to maintain effective internal control over financial reporting may have an adverse effect on our

financial condition and stock price. |

| • |

|

Your percentage ownership in us may be diluted by future issuances of capital stock, which could reduce your

influence over matters on which stockholders vote. |

| • |

|

A sale of a portion of our total outstanding shares could cause the market price of our Class A common stock

to drop significantly. |

17

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion (as adjusted for inflation from time to time pursuant to the rules of the Securities and

Exchange Commission (the “SEC”)) in annual gross revenue during our last fiscal year, we qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). An emerging growth

company may take advantage of reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company:

| |

• |

|

we may present as few as two years of audited financial statements and two years of related management discussion

and analysis of financial condition and results of operations; |

| |

• |

|

we are exempt from the requirement to obtain an attestation report from our auditors on management’s

assessment of our internal control over financial reporting under the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”), for up to five years or until we no longer qualify as an emerging growth company;

|

| |

• |

|

we are permitted to provide reduced disclosure regarding our executive compensation arrangements pursuant to the

rules applicable to smaller reporting companies, which means we do not have to include a compensation discussion and analysis and certain other disclosures regarding our executive compensation; and |

| |

• |

|

we are not required to hold non-binding advisory votes on

executive compensation or golden parachute arrangements. |

In addition to the relief described above, the JOBS Act permits

us an extended transition period for complying with new or revised accounting standards affecting public companies. We have elected to use this extended transition period, which means that our financial statements may not be comparable to the

financial statements of public companies that comply with such new or revised accounting standards on a non-delayed basis.

In this prospectus we have elected to take advantage of the reduced disclosure requirements relating to executive compensation, and in the

future we may take advantage of any or all of these exemptions for so long as we remain an emerging growth company. We will remain an emerging growth company until the earliest of (i) the end of the fiscal year during which we have total annual

gross revenue of $1.07 billion (as adjusted for inflation pursuant to SEC rules from time to time) or more, (ii) December 31, 2026, (iii) the date on which we have, during the previous three-year period, issued more than

$1.0 billion in non-convertible debt or (iv) the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended (the

“Exchange Act”).

Corporate Information

Xponential Fitness LLC was founded in August 2017 and Xponential Fitness, Inc. was incorporated in the State of Delaware on January 14,

2020. Xponential Fitness LLC became a wholly owned subsidiary of Xponential Holdings LLC on February 24, 2020. Our principal executive offices are located at 17877 Von Karman Ave, Suite 100, Irvine, CA, 92614 and our telephone number is (949) 346-3000. Our website is located at www.xponential.com. Our website and the information contained therein or connected thereto, or accessible therefrom, is not incorporated into this prospectus or the registration

statement of which it forms a part.

18

THE OFFERING

| Class A common stock offered by the selling stockholders |

4,500,000 shares (or 5,175,000 shares if the underwriters exercise their option to purchase additional shares of Class A common stock in full). |

| Class A common stock to be outstanding after this offering |

26,405,292 shares (or 26,756,900 shares if the underwriters exercise their option to purchase additional shares of Class A common stock in full). If all outstanding LLC Units held by the Continuing

Pre-IPO LLC Members (as defined herein) were redeemed or exchanged for newly issued shares of Class A common stock on a

one-for-one basis, 46,892,468 shares of Class A common stock. |

| Class B common stock to be outstanding after this offering |

20,487,176 shares (or 20,135,568 shares if the underwriters exercise their option to purchase additional shares of Class A common stock in full). |

| Voting power held by holders of Class A common stock after giving effect to this offering |

43% (or 44% if the underwriters also exercise their right to purchase additional shares of Class A common stock in full). |

| Voting power held by holders of Class B common stock after giving effect to this offering |

34% (or 33% if the underwriters exercise their right to purchase additional shares of Class A common stock in full) (or 0% if all outstanding LLC Units held by the Continuing Pre-IPO LLC Members were

redeemed or exchanged for a corresponding number of newly issued shares of Class A common stock). |

| Voting rights |

Each share of Class A common stock and Class B common stock (collectively, our “common stock”) entitles its holder to one vote per share. |

| |

Our Class A common stock, Class B common stock and Series A preferred stock generally vote together as a single class on all matters submitted to a vote of our stockholders. |

| Use of Proceeds |

We will not receive any proceeds from the sale of the shares of our Class A common stock. |

| Redemption rights of the holders of LLC Units |

Under the Amended LLC Agreement (as defined herein), holders of LLC Units (other than us) have the right (subject to the terms of the Amended LLC

Agreement) to require Xponential Holdings LLC to redeem all or a portion of their LLC Units for, at our election, newly issued shares of Class A common stock on a

one-for-one basis or a |

19

| |

cash payment determined in accordance with the terms of the Amended LLC Agreement, provided the cash payment is funded from the net proceeds from a substantially contemporaneous offering of

Class A common stock in accordance with the terms of the Amended LLC Agreement. Additionally, in the event of a redemption request from a holder of LLC Units, we may, at our option, effect a direct exchange of cash or Class A common stock

for LLC Units in lieu of such a redemption. Shares of Class B common stock will be cancelled on a one-for-one basis if we, following a redemption request from a