forth in Sections 11(b)-(f) without having to convert their Series A Convertible Preferred Stock as if they held a number of shares of Class A Common Stock equal to (x) the Fixed Liquidation Preference divided by the Conversion Price as of the Record Date for such transaction, multiplied by (y) the number of shares of Series A Convertible Preferred Stock held by such holder. The Conversion Rate shall not, however, be adjusted with respect to any use of the proceeds of the offer and sale of the Series A Convertible Preferred Stock pursuant to the Securities Purchase Agreement or in connection with any transaction contemplated by the Up-C Steps Memo (as defined in the Securities Purchase Agreement).

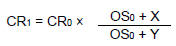

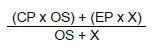

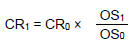

(b) If the Company exclusively issues shares of Class A Common Stock as a dividend or distribution on shares of Class A Common Stock, or if the Company effects a share split or share combination of the Class A Common Stock, the Conversion Rate shall be adjusted based on the following formula:

where,

| CR0 = | the Conversion Rate in effect immediately prior to the close of business on the Record Date of such dividend or distribution, or immediately prior to the open of business on the Effective Date of such share split or share combination, as applicable; | |

| CR1 = | the Conversion Rate in effect immediately after the close of business on such Record Date or immediately after the open of business on such Effective Date, as applicable; | |

| OS0 = | the number of shares of Class A Common Stock outstanding immediately prior to the close of business on such Record Date or immediately prior to the open of business on such Effective Date, as applicable, before giving effect to such dividend, distribution, share split or share combination; and | |

| OS1 = | the number of shares of Class A Common Stock outstanding immediately after giving effect to such dividend, distribution, share split or share combination. | |

Any adjustment made under this Section 11(b) shall become effective immediately after the close of business on the Record Date for such dividend or distribution, or immediately after the open of business on the Effective Date for such share split or share combination, as applicable. If any dividend or distribution of the type set forth in this Section 11(b) is declared but not so paid or made, the Conversion Rate shall be immediately readjusted, effective as of the date the Board of Directors or a committee thereof determines not to pay such dividend or distribution, to the Conversion Rate that would then be in effect if such dividend or distribution had not been declared. For the purposes of this Section 11(b), the number of shares of Class A Common Stock outstanding immediately prior to the close of business on the Record Date and the number of shares of Class A Common Stock outstanding immediately after giving effect to such dividend, distribution, share split or share combination shall, in each case, not include shares that the Company holds in treasury. The Company shall not pay any dividend or make any distribution on shares of Class A Common Stock that it holds in treasury.

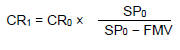

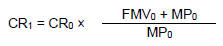

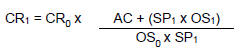

(c) If the Company issues to all or substantially all holders of Class A Common Stock any rights, options or warrants entitling them, for a period of not more than 45 calendar days after

23