UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under § 240.14a-12

|

Xponential Fitness, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☒

|

No fee required.

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

May 17, 2024

Dear Stockholders:

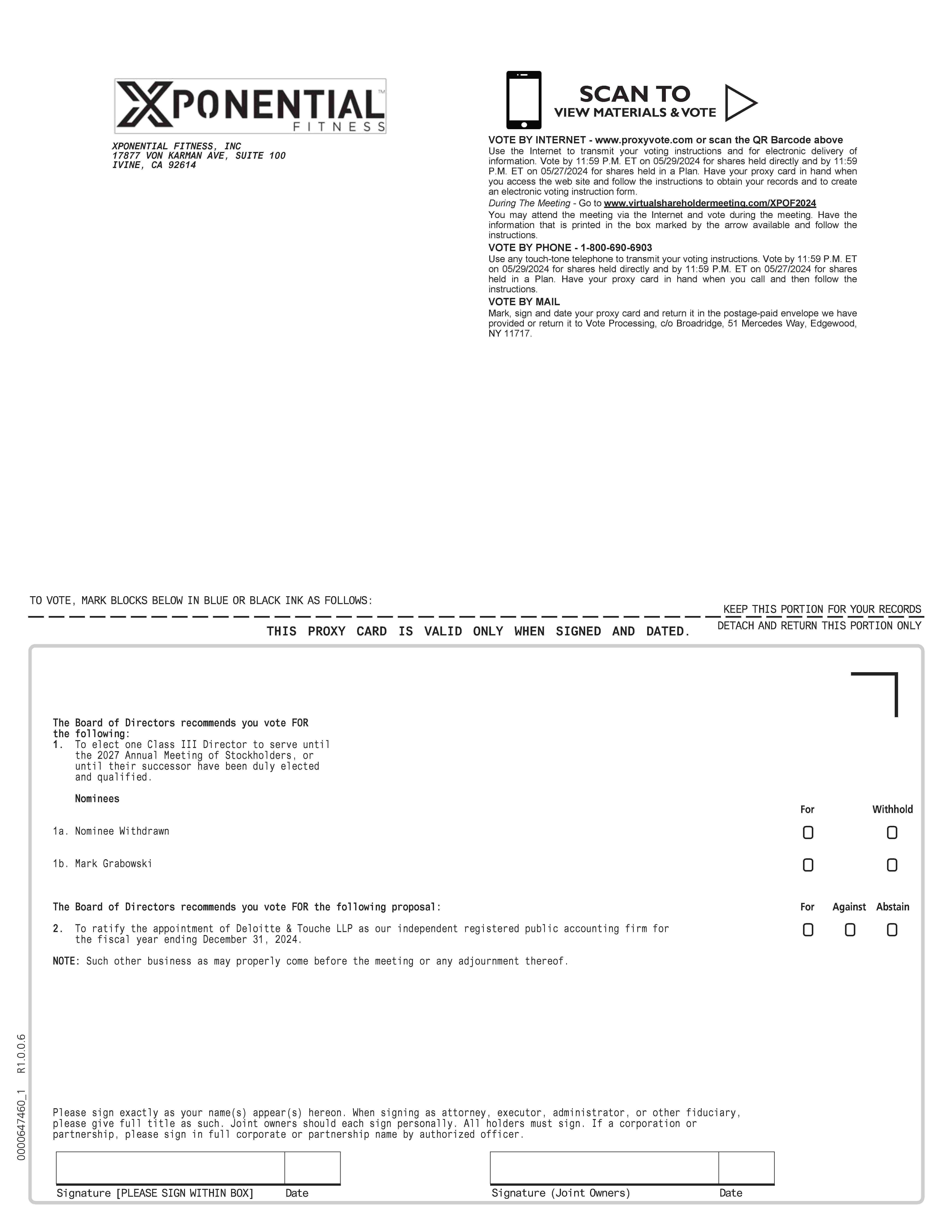

The Board of Directors (the “Board”) of Xponential Fitness, Inc. (“we”, “us”, “our” or the “Company”) has determined that Mr. Geisler will no longer be re-nominated to serve as a Class III director in connection with the Company’s 2024 Annual

Meeting of Stockholders (the “Annual Meeting”). As such, following the certification of the vote at the Annual Meeting, Mr. Geisler will no longer be a director of the Company.

We are providing you with additional information in the enclosed Supplement (the “Supplement”) to the Company’s Proxy Statement filed with the Securities and Exchange Commission on April 18, 2024 (the “Proxy Statement”), as well as an amended

notice of Annual Meeting and proxy card, to remove Mr. Geisler as a director nominee, while continuing to allow stockholders to vote for Mr. Mark Grabowski as the remaining Class III director nominee pursuant to Proposal 1, Election of Directors.

If you have not already voted your shares on the proposals to be voted on at the Annual Meeting, we urge you to do so today. If you have already voted your shares on the proposals to be voted on at the Annual Meeting, we encourage you to

resubmit your vote on the proposals. The receipt of your new proxy or voting instructions will revoke and supersede any proxy or voting instructions you previously submitted. If you have already voted and do not submit new voting instructions, your

previously submitted proxy or voting instructions will be voted at the Annual Meeting in accordance with your instructions with respect to Mr. Grabowski and the ratification of the auditor, and will be disregarded with respect to the election of

Mr. Geisler. In this regard, any votes cast with respect to Mr. Geisler will be disregarded and will not be counted, as Mr. Geisler is no longer standing for re-election at the Annual Meeting.

Please read the Proxy Statement that was previously made available to stockholders and the attached Supplement in their entirety, as well as the amended notice of Annual Meeting and proxy card, as together they contain all of the information

that is important to your decisions in voting at the Annual Meeting.

By Order of the Board of Directors

/s/ Mark Grabowski

Mark Grabowski

Chairman of the Board

XPONENTIAL FITNESS, INC.

17877 Von Karman Ave., Suite 100

Irvine, CA 92614

Amended Notice of Annual Meeting of Stockholders To Be Held Thursday, May 30, 2024

The Annual Meeting of Stockholders (the “Annual Meeting”) of Xponential Fitness, Inc., a Delaware corporation (the “Company”), will be held at 10:00 a.m., Pacific Time, on Thursday, May 30, 2024. The

Annual Meeting will be held virtually. You will be able to attend the Annual Meeting online by visiting www.virtualshareholdermeeting.com/XPOF2024 and entering your 16-digit control number included on your proxy card that is enclosed with your proxy

materials. This website will contain instructions on how to participate in the Annual Meeting in advance of the meeting. The Company has designed the format of the Annual Meeting to ensure that stockholders are afforded the same rights and

opportunities to participate as they would at an in-person meeting, using online tools to ensure stockholder access and participation. You will be able to submit written questions at the meeting and vote online. The Annual Meeting will be held for

the following purposes:

|

•

|

To elect one Class III Director to serve until the 2027 annual meeting of stockholders, or until his successor shall have been duly elected and qualified or until such director’s earlier death, resignation or

removal;

|

|

•

|

To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024; and

|

|

•

|

To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting.

|

Holders of record of our Class A common stock, Class B common stock and Series A preferred stock as of the close of business on April 2, 2024 (the “Record Date”) are entitled to notice of and to vote

at the Annual Meeting, or at any continuation, postponement or adjournment of the Annual Meeting. The Annual Meeting may be continued or adjourned from time to time without notice other than by announcement at the Annual Meeting.

It is important that your shares be represented regardless of the number of shares you may hold. Whether or not you plan to attend the Annual Meeting, we urge you to vote your shares via the

toll-free telephone number or over the Internet, as described in the enclosed materials. If you received a copy of the proxy card by mail, you may sign, date and mail the proxy card in the enclosed return envelope. Promptly voting your shares will

ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy is

revocable at your option.

This Amended Notice of Annual Meeting, Proxy Statement, Supplement to Proxy Statement and the Annual Report are available at: www.proxyvote.com

By Order of the Board of Directors

/s/ Mark Grabowski

Mark Grabowski

Chairman of the Board

Irvine, California

May 17, 2024

Supplement to Xponential Fitness, Inc. Proxy Statement for

The 2024 Annual Meeting of Stockholders

to be held on Thursday, May 30, 2024 at 10:00 a.m. (Pacific Time)

This Supplement, dated May 17, 2024, is furnished to the stockholders of Xponential Fitness, Inc. (the “Company”) in connection with the solicitation of proxies for use at the 2024 Annual Meeting of Stockholders to be held on Thursday, May 30,

2024 at 10:00 a.m. Pacific Time (the “Annual Meeting”), or at any adjournments or postponements thereof, pursuant to the accompanying Amended Notice of Annual Meeting of Stockholders. The Annual Meeting will be held virtually. This Supplement,

Amended Notice of Annual Meeting of Stockholders, and revised proxy card, supplement and amend the Proxy Statement, Notice of Annual Meeting of Stockholders, and Proxy Card, each dated April 18, 2024.

This Supplement contains important information about recent developments and should be read in conjunction with the Proxy Statement and Amended Notice of Annual Meeting of Stockholders. Furthermore, this Supplement is

being furnished to provide information related to Proposal 1. This Supplement does not provide all of the information that is important to your decisions in voting at the Annual Meeting. Additional information is contained in the Proxy Statement for

our Annual Meeting that was previously sent to our stockholders.

On April 18, 2024, the Company filed its proxy statement (the “Proxy Statement”) relating to the Annual Meeting with the Securities and Exchange Commission and began mailing the Proxy Statement or Notice of Internet Availability to its

stockholders on or about April 18, 2024. Subsequent to that date, the Board of Directors of the Company (the “Board”) decided that Mr. Anthony Geisler would no longer be a director nominee. As such, Mr. Geisler’s term as a director will expire upon

the certification of the vote at the Annual Meeting. These additional materials have been prepared to provide the Company’s stockholders with information regarding Mr. Geisler no longer standing for election.

The amended proxy card enclosed with this Supplement differs from the proxy card previously furnished to you with the Proxy Statement dated April 18, 2024 in that the enclosed amended proxy card removes Mr. Geisler’s nomination as a director of

the Company. If you have not already voted your shares on the proposals to be voted on at the Annual Meeting, we urge you to do so today. If you have already voted your shares on the proposals to be voted on at the Annual Meeting, we encourage you

to resubmit your vote on the proposals. The receipt of your new proxy or voting instructions will revoke and supersede any proxy or voting instructions you previously submitted. If you have already voted and do not submit new voting instructions,

your previously submitted proxy or voting instructions will be voted at the Annual Meeting in accordance with your instructions with respect to Mr. Grabowski and the ratification of the auditor, and will be disregarded with respect to the election

of Mr. Geisler. Any votes cast with respect to Mr. Geisler for director will be disregarded and will not be counted, as Mr. Geisler is no longer standing for re-election at the Annual Meeting.

The Proxy Statement is hereby supplemented and amended as follows:

| • |

All references to Mr. Geisler standing for election as a director of the Company are deleted.

|

| • |

All references to two class III directors standing for election at the Annual Meeting are replaced with a reference to one class III director.

|

The first paragraph under the heading “Proposal 1: Election of Directors” on page 7 of the Proxy Statement is supplemented by amending and restating such paragraph

as follows:

Our Board currently consists of six (6) director positions, and following the Annual Meeting we will have five

(5) members on our Board. We intend for any vacancies to remain until our Board desires to fill such vacancies or reduce the size of the Board. At this time the Board believes that five (5) directors is an appropriate number of directors and does

not intend to fill the director vacancy until a qualified candidate is identified and accepts an appointment. At the Annual Meeting, one (1) nominee for Class III director, Mr. Mark Grabowski, is to be elected to hold office until the Company’s

annual meeting of stockholders to be held in 2027, until such director’s successor is elected and qualified or until such director’s earlier death, resignation or removal. You may not vote for a greater number of directors than those nominated.

The following text is inserted below paragraph 6 on page 7:

Withdrawal of Director Nominee

The Board has withdrawn its nomination of Mr. Geisler as a director at the Annual Meeting and no nominee for election at the Annual Meeting will be named in place of Mr. Geisler.

As discussed in the Proxy Statement, the Board is nominating Mark Grabowski as the sole Class III nominee for election to the Board at the Annual Meeting. Mr. Grabowski’s term will expire at the Company's annual meeting of stockholders to be held

in 2027 or until the election and qualification of his successor, or until his earlier death, resignation or removal.

The following text supplements the “Corporate Governance” Section beginning on page 13:

CORPORATE GOVERNANCE

As discussed in the Proxy Statement and outlined in our corporate governance guidelines, our Board determines its leadership structure in a manner that it determines to be in the best interests of the Company and its stockholders. At this time,

the Board has determined that the Company and its stockholders will be best served with Ms. Chelsea Grayson as Lead Independent Director. Further, the Board has determined that Ms. Brenda Morris will not serve on any committee of the Board while

serving as Interim Chief Executive Officer of the Company, and Ms. Grayson will serve as chair of the Audit Committee. The Board will continue to consider the appropriate leadership, size and constitution of the Board.

The following text is inserted immediately after the section titled “Anti-Hedging Policy” on page 15:

Pledging Policy

On May 17, 2024, the Board adopted a Pledging Policy that prohibits after such date Company directors, executive officers and their immediate family members from holding Company securities in a margin account and

pledging Company securities as collateral to secure or guarantee indebtedness. Under the Pledging Policy, Company securities pledged as of May 17, 2024 as disclosed on page 26 in the footnotes to the beneficial ownership table beginning on page

25 were permitted to continue but the pledging of additional securities is prohibited.

The following text is inserted at the end of footnote 6 on page 26:

142,360 of the shares of Class A common stock held directly by Ms. Luna are pledged as collateral to secure personal indebtedness pursuant to a security and pledge agreement.

The following text is inserted at the end of footnote 7 on page 26:

96,922 of the shares of Class A common stock held directly by Mr. Meloun are pledged as collateral to secure personal indebtedness pursuant to a security and pledge agreement.

***

This Supplement, the Amended Notice, and the amended proxy card is first being released to stockholders on or about May 17, 2024 and should be read together with the Proxy Statement. The information

contained in this Supplement, the Amended Notice, and the amended proxy card modifies or supersedes any inconsistent information contained in the Proxy Statement, original notice, and original proxy card.