or the account of any other holder (excluding any registration related to an employee benefit plan or in connection with any dividend or distribution reinvestment or similar plan or other transaction under Rule 145 of the Securities Act), the Continuing Pre-IPO LLC Members are entitled to notice of such registration and to request that we include their registrable securities for resale on such registration statement, and we are required, subject to certain limitations, to include such registrable securities in such registration statement.

We undertake in the Registration Rights Agreement to use our reasonable efforts to file a shelf registration statement on Form S-3 to permit the resale of the shares of common stock held by Continuing Pre-IPO LLC Members.

In connection with the transfer of their registrable securities, the parties to the Registration Rights Agreement may assign certain of their respective rights under the Registration Rights Agreement under certain circumstances. In connection with the registrations described above, we will indemnify any selling stockholders, and we will bear all fees, costs and expenses (except underwriting discounts and spreads).

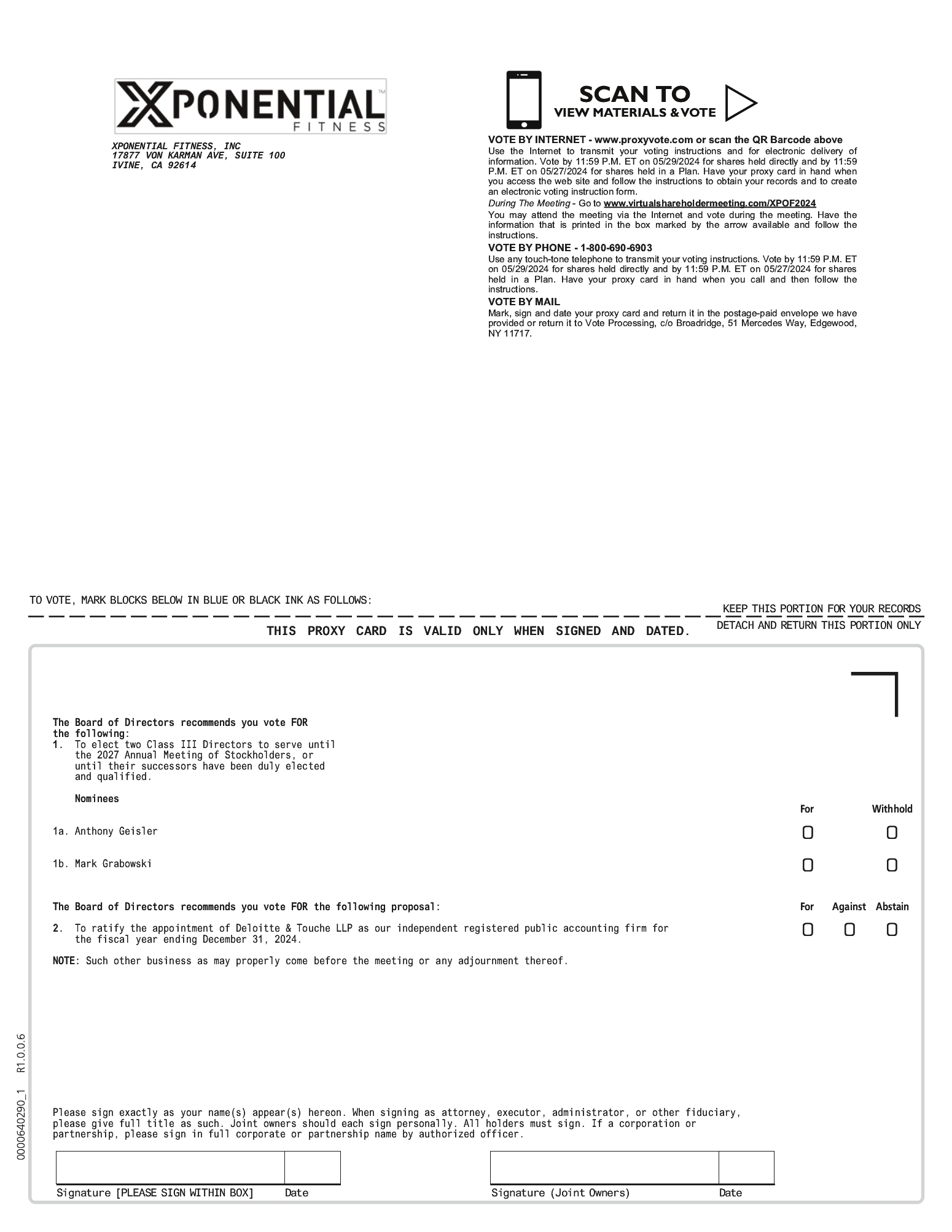

Transactions with Snapdragon Spartan and Mark Grabowski

In March 2023, Spartan Fitness Holdings, LLC (“Spartan Fitness”), which currently owns and operates 78 Club Pilates studios, entered into a unit purchase agreement with Snapdragon Spartan Investco LP (the “Spartan SPV”), a special purpose vehicle controlled and managed by Mr. Grabowski, Chairman of our Board of Directors, pursuant to which the Spartan SPV agreed to invest an aggregate of approximately $30 million in the equity of Spartan Fitness. In addition, Mr. Grabowski invested an aggregate of $1.2 million as a limited partner in the Spartan SPV. Spartan Fitness intends to use approximately $15 million of the total investment from Spartan SPV to fund expansion of Club Pilates studios, among other concepts. Spartan Fitness also owns the rights to 89 Club Pilates licenses to open additional new units. We recorded franchise, equipment and marketing fund revenue aggregating $6.4 million during the year ended December 31, 2023 from studios owned by Spartan Fitness.

Transactions with Ryan Junk

We recorded net revenues from a CycleBar studios franchisee who is also a part of our senior management, Ryan Junk, our Chief Operating Officer. Revenues from these CycleBar studios, primarily related to franchise revenue, marketing fund revenue, package and memberships revenue and merchandise revenue, were approximately $506,000, in 2023.

In 2018, we entered into an offer letter with Mrs. Lindsay Junk, who is the spouse of Ryan Junk, pursuant to which Mrs. Junk was employed by us as the President of YogaSix. Mrs. Junk’s total compensation, including stock awards (as outlined below) and bonus, was approximately $321,000 in 2023. We note that Mrs. Junk’s total compensation package is in line with our presidents of similar sized brands.

In 2023, we granted 3,617 RSUs under our OIP to Mrs. Junk, which vested immediately. Additionally, Mrs. Junk’s bonus for the fourth quarter of 2023 was paid in the form of fully-vested RSUs in February 2024 and has been included in the total 2023 compensation amount for Mrs. Junk disclosed above.

Disgorgement of stockholders short-swing profits

In August 2023, we received payment from Anthony Geisler, our Chief Executive Officer, of $506,790 related to disgorgement of short-swing profits under Section 16(b) of the Exchange Act.

Indemnification

Our Amended and Restated Certificate of incorporation contains provisions limiting the liability of directors, and our Amended and Restated Bylaws provide that we will indemnify each of our directors, officers, employees and other agents to the fullest extent permitted under Delaware law. In addition, in connection with our IPO, we agreed to enter into an indemnification agreement with each of our directors and executive officers, which will require us to indemnify them.

Related Person Transactions Policy

We have adopted a written Related Person Transaction Policy, which sets forth our policy with respect to the review, approval, ratification and disclosure of all related person transactions by our Audit Committee. In accordance with its terms, our Audit Committee will have overall responsibility for the implementation of, and for compliance with the Related Person Transaction Policy.