UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number

(Exact name of Registrant as specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|||

|

☒ |

|

Smaller reporting company |

|

||

|

|

|

|

|

|

|

Emerging growth company |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES

The registrant completed the initial public offering of its Class A Common Stock on July 23, 2021. Accordingly, there was

The number of shares of Registrant’s Class A Common Stock and Class B Common Stock outstanding as of February 25, 2022 was

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement relating to its 2022 annual meeting of stockholders, to be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates, are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated.

Table of Contents

|

|

Page |

PART I |

|

|

Item 1. |

4 |

|

Item 1A. |

23 |

|

Item 1B. |

65 |

|

Item 2. |

65 |

|

Item 3. |

65 |

|

Item 4. |

65 |

|

|

|

|

PART II |

|

|

Item 5. |

66 |

|

Item 6. |

66 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

67 |

Item 7A. |

89 |

|

Item 8. |

90 |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

131 |

Item 9A. |

131 |

|

Item 9B. |

132 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

132 |

|

|

|

PART III |

|

|

Item 10. |

133 |

|

Item 11. |

133 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

133 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

133 |

Item 14. |

133 |

|

|

|

|

PART IV |

|

|

Item 15. |

134 |

|

Item 16. |

136 |

|

|

137 |

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements reflect, among other things, our current expectations and anticipated results of operations, all of which are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements, market trends, or industry results to differ materially from those expressed or implied by such forward-looking statements. Therefore, any statements contained herein that are not statements of historical fact may be forward-looking statements and should be evaluated as such. Without limiting the foregoing, the words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “should,” “would,” “could,” “will,” “likely” and the negative thereof and similar words and expressions are intended to identify forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in “Item 1A. – Risk Factors,” of this report. Unless legally required, we assume no obligation to update any such forward-looking information to reflect actual results or changes in the factors affecting such forward-looking information.

3

PART I

Item 1. Business.

Overview

Xponential Fitness, Inc. (the “Company” or “XPO Inc”) was formed as a Delaware corporation on January 14, 2020. On July 23, 2021, the Company completed an initial public offering (“IPO”) of 10,000,000 shares of Class A common stock. Pursuant to a reorganization into a holding company structure, the Company is a holding company with its principal asset being a controlling ownership interest in Xponential Fitness LLC (“XPO LLC”) through its ownership interest in Xponential Intermediate Holdings, LLC (“XPO Holdings”). The Company’s Class A common stock trades on the New York Stock Exchange under the symbol “XPOF”.

XPO LLC, the principal operating subsidiary of XPO Inc. is the largest global franchisor of boutique fitness brands. The Company operates a diversified platform of ten brands spanning across verticals including Pilates, indoor cycling, barre, stretching, rowing, dancing, boxing, running, functional training and yoga. XPO LLC franchisees offer energetic, accessible, and personalized workout experiences led by highly qualified instructors in studio locations across 48 U.S. states, the District of Columbia and Canada, and through master franchise agreements or international expansion in ten additional countries. The Company's portfolio of brands includes Club Pilates, the largest Pilates brand in the United States; CycleBar, the largest indoor cycling brand in the United States; StretchLab, a concept offering one-on-one and group stretching services; Row House, a high-energy, low-impact indoor rowing workout; AKT, a dance-based cardio workout combining toning, interval and circuit training; YogaSix, the largest franchised yoga brand; Pure Barre, a total body workout that uses the ballet barre to perform small isometric movements; Stride, a treadmill-based cardio and strength training concept; Rumble, a boxing-inspired full-body workout; and BFT, a functional training and strength-based program.

The foundation of our business is built on strong partnerships with franchisees. We provide franchisees with extensive support to help maximize the performance of their studios and enhance their return on investment. In turn, this partnership accelerates our growth and increases our profitability. We believe our unique combination of a scaled multi-brand offering, resilient franchise model with strong unit economics and integrated platform has enabled us to build our leading market position in the large and growing U.S. boutique fitness industry.

We carefully built the Xponential Fitness brand portfolio through a series of acquisitions, targeting select health and wellness verticals. In curating our portfolio, we identified brands with exceptional programming and a loyal consumer base which we believed would benefit from our operational expertise, franchising experience and scaled platform. With over 250 years of collective industry experience, our management team and brand presidents are the driving force behind our operational excellence. We have established a proven operational model (the “Xponential Playbook”) that helps franchisees generate compelling studio economics. This model has allowed us to provide extensive support to franchisees during the COVID-19 pandemic. The key pillars of our Xponential Playbook include:

4

The Xponential Playbook is designed to help franchisees achieve compelling Average Unit Volumes (“AUVs”), strong operating margins and an attractive return on their invested capital. Studios are generally designed to be between 1,500 and 2,500 square feet in size, depending on the brand. The smaller box format contributed to a relatively low average initial franchisee investment of approximately $350,000 in 2021 and 2020. By utilizing the Xponential Playbook, our model is generally designed to generate, on average, an AUV of approximately $500,000 in year two of operations and studio-level operating margins ranging between 25% and 30%, resulting in an unlevered cash-on-cash return of approximately 40%.

We believe our integrated platform, which supports our ten brands, is a unique competitive advantage in the boutique fitness industry and enables us to accelerate growth and enhance operating margins. Our multi-brand offering results in higher franchisee lead flow and conversion, which lowers franchisee acquisition costs. Existing franchisees also serve as an embedded pipeline for continued expansion across our brands. As a result of our scale, we benefit from greater access to real estate and favorable vendor relationships. Additionally, we leverage shared corporate services across franchise sales, real estate, supply chain, merchandising, information technology, finance, accounting and legal. As an integrated platform, we utilize technology to provide improved functionality, drive efficiency and access compelling data across our brands. Our robust digital platform, with content spanning all of our brands except Rumble and BFT, is an important example of our ability to utilize our integrated platform to enhance our individual brand offerings and member retention. We also benefit from knowledge sharing and best practices across the portfolio. We believe that we are in the early stages of unlocking the power of our platform and driving long-term growth.

As a franchisor, we benefit from multiple highly predictable and recurring revenue streams that enable us to scale our franchised studio base in a capital efficient manner. As of December 31, 2021, franchisees were contractually committed to open an additional 1,806 studios in North America. Converting our current pipeline of licenses sold to open studios in North America would nearly double our existing franchised studio base. Based on our internal and third-party analyses by Buxton Company, we estimate that franchisees could have a total of approximately 6,900 studios in the United States alone, prior to our acquisition of BFT. While no formal analysis has been conducted to assess the incremental studio opportunity attributable to BFT, Buxton expects that the addition of BFT will add approximately 1,000 more independent studio opportunities to our United States whitespace provided that we and BFT continue to operate in a manner consistent with the rest of our brands. In addition, we had 176 studios operating in eight countries internationally and master franchisees were contractually obligated to sell licenses to franchisees to open an additional 956 studios in ten countries, of which master franchisees have sold 184 licenses for studios not yet opened as of December 31, 2021.

As a result of the COVID-19 pandemic, our results of operations and the businesses of our franchisees were adversely affected beginning in March 2020 continuing through the remainder of 2020. The adverse effects of the COVID-19 pandemic began to decline in 2021, although, infection rates continued to fluctuate in various regions and new strains and variants of the virus, including the delta and omicron variants, remain a risk. Beginning in the second quarter of 2021 as vaccination rates in the United States increased substantially and restrictions on indoor fitness classes were reduced or eliminated in most states, franchisees’ membership visits have increased. We believe that consumers will return to boutique fitness at increasing levels in 2022 as recreational activity continues to return to more customary levels, and fitness activities continue to break from the solitary home fitness solutions that many consumers adopted during the COVID-19 pandemic.

Our Industry

We operate in the large and growing boutique fitness segment of the broader health and fitness club industry. Boutique fitness encompasses a social, supportive community of coaches and consumers engaging through class-based programming in small studio spaces (typically 1,500-2,500 square feet). A boutique fitness workout typically offers more customized programming and a more intensive experience complemented by increased levels of personal attention and guidance relative to a traditional health and fitness club.

5

Before the COVID-19 pandemic, the International Health, Racquet & Sportsclub Association (“IHRSA”) estimated the size of the global health and fitness club industry at $96.7 billion, with more than 205,000 clubs serving over 184 million members in 2019. Prior to the COVID-19 pandemic, the U.S. health and fitness club industry experienced annual growth for more than 21 consecutive years. IHRSA estimated the U.S. health and fitness club industry at $35.0 billion in 2019. The U.S. boutique fitness market, the segment where we operate, was estimated at $21.1 billion in 2019, according to an independent analysis we had commissioned from Frost & Sullivan. Boutique fitness grew more rapidly than overall fitness, and the target consumer spent more and engaged more frequently than the average health and fitness club member in 2019.

The industry saw unprecedented damage in 2020 and 2021, with 2020 U.S. health and fitness club revenue declining by 58% according to IHRSA. As of January 1, 2022, 30% of boutique fitness studios had closed permanently, according to IHRSA.

As the largest franchisor in the boutique fitness industry, we saw continued strong growth during the COVID-19 pandemic. We opened 555 new studios globally between April 2020 and December 2021, including studios opened by Rumble and BFT. Our member base today is approximately 30% larger than it was before the onset of the COVID-19 pandemic.

Our Competitive Strengths

Diversified portfolio of leading boutique fitness brands.

Our portfolio of ten diversified brands spans a variety of popular fitness and wellness verticals including Pilates, barre, cycling, stretching, rowing, yoga, boxing, dancing, running and functional training. We believe that our diversification represents a significant competitive advantage in a fragmented market comprised primarily of single-brand companies focused on an individual fitness or wellness vertical. The complementary nature of our brands allows our franchised studios to be located in close proximity to one another, providing variety and convenience to both consumers and franchisees. Our brands appeal to a broad range of consumers across ages, fitness levels and demographics and are positioned at an accessible price point. The strength of our brands is highlighted by the numerous accolades they have received, with four brands (Club Pilates, Pure Barre, CycleBar and StretchLab) each being listed among Entrepreneur’s 2022 Franchise 500 rankings and BFT being voted the 2020 APAC Franchise of the Year. We believe that our diversified brand offering expands our total addressable market and translates into increased use occasions for consumers, driving increased share of wallet and enhancing consumer lifetime value across our portfolio.

Market leading position with significant nationwide scale.

We are the largest boutique fitness franchisor in the United States with over 1,900 studios operating across ten brands in the United States. Our three largest brands have leading market share positions within their respective verticals. These brands, Club Pilates, Pure Barre and CycleBar, were approximately nine, four and three times larger than their next largest competitors, respectively, as of December 31, 2021. As the leaders in these verticals, and as one of few players of scale, we believe that we occupy an advantageous position in an otherwise highly fragmented boutique fitness market.

We are able to leverage the popularity and reputation of existing Xponential studios to support both new studio sales to franchisees and to support franchisees’ ability to attract new customers to their studios. We believe that the continued expansion of the Xponential platform creates a network effect that reinforces our competitive position, making us increasingly attractive to potential franchisees and making studios increasingly popular with boutique fitness consumers. In conjunction with our scale, we have been able to achieve broad geographic diversification across the United States with studios in 48 states and the District of Columbia as of December 31, 2021. Our geographic reach represents a material competitive advantage, as we have demonstrated success across various markets, and we are able to remain competitive nationally when extraordinary events heavily impact specific markets.

6

Passionate, growing and loyal consumer base.

Our franchised studios provide differentiated and accessible boutique fitness experiences that are fun, energetic and deliver a strong sense of community, engendering loyalty and engagement with consumers. Across our system, over 1.3 million unique consumers completed nearly 30 million in-studio, live stream and virtual workouts in 2021. The loyalty of our consumer base is evidenced by our franchisees’ ability to recover to approximately 113% of actively paying members as of December 31, 2021, relative to December 31, 2019 levels and membership visits for the quarter ended December 31, 2021 were at 117% relative to the quarter ended December 31, 2019 levels (excludes Rumble and BFT). For the quarter ended December 31, 2021, run-rate AUVs recovered to approximately 94% relative to the quarter ended December 31, 2019 (includes Rumble and BFT). We believe that we were able to deepen our consumer loyalty during the COVID-19 pandemic through our robust digital platform offering, as well as the personal efforts of exceptional franchisees to strengthen their studio communities. Our digital platform had over 24,000 subscribers and offered over 2,800 digital workouts in our library with multiple class formats within each brand as of December 31, 2021. Approximately 90% of class bookings were done through the Xponential brand app in the 90 days ending December 31, 2021. Our brands serve a broad demographic; our consumer skews female and is typically between the ages of 20 and 60 years old, holds at least a bachelor’s degree and reports household income greater than $75,000 per year. In addition, we continually seek ways to further heighten the Xponential consumer experience. As of December 31, 2021, studios had over 440,000 members, of which over 390,000 were actively paying members on recurring membership packages (excludes Rumble and BFT). For example, we launched a partnership with Apple in March 2021 that features Apple Watch integration across all of our popular fitness and wellness verticals, excluding BFT, and is designed to increase consumer engagement and retention across our franchised studios. Our franchised studios foster consumer engagement, personal accountability to achieve fitness goals and a strong sense of community, which drive repeat visits and maximize consumer lifetime value.

Xponential Playbook supports system-wide operational excellence.

We strategically partner with franchisees who have been vetted by a thorough selection process. Through the Xponential Playbook, we provide franchisees with significant support from the outset, focused on delivering a superior experience and maximizing studio-level productivity and profitability. Franchisees also benefit from the significant investments we have made in our corporate platform, through which we leverage integrated systems and shared services. While marketing and fitness programming are specific to each brand, nearly all other franchisee support functions are integrated across brands at the corporate level, and franchisees are guided through the key pillars of successful studio operations.

We believe the relationships we maintain with franchisees drive tangible results for consumers: well-managed boutique fitness studios; access to technology capabilities; retention of highly qualified instructors; and a consistent, community-based experience across brands and geographies. We believe the extensive level of support we provide to franchisees is a key driver of system-wide operational excellence.

Asset-light franchise model and predictable revenue streams.

We believe our asset-light franchise model drives faster system-wide unit growth, compared to a similarly capitalized corporate-owned model. As a franchisor, we have multiple highly predictable revenue streams and low ongoing capital requirements. Upon the granting of access to a license, we receive a one-time, non-refundable upfront payment from franchisees for the right to open a studio in a specific territory. This is followed by a series of contractual payments once a studio is open, many of which are recurring, including royalty fees, technology fees, merchandise sales, marketing fees and instructor and management training revenues. Approximately 77% of our revenue in 2021 and 73% of our revenue in 2020 was considered recurring, and we believe this percentage will increase as franchise royalty fees are expected to account for a greater percentage of our revenue over time.

7

Highly attractive and predictable studio-level economics.

The Xponential Playbook is designed to help franchisees achieve compelling AUVs, strong operating margins and an attractive return on their invested capital. Studios are generally designed to be between 1,500 and 2,500 square feet in size, depending on the brand, which contributed to a relatively low average initial franchisee investment of approximately $350,000 in 2021 and 2020. Our model is generally designed to generate, on average under normal conditions, an AUV of $500,000 in year two of operations and studio-level operating margins ranging between 25% and 30%, resulting in an unlevered cash-on-cash return of approximately 40%. A studio reaches “base maturity” when it has annualized monthly revenues in the $400,000 to $600,000 AUV range. Using our model, we expect this to typically occur 6-12 months after studio opening. We believe that studios typically have opportunity to continue growing and maturing beyond that point, however.

We believe the continued growth of the franchisee system reflects the attractiveness of our unit economic model. In 2021, 252 new franchisees joined our system in North America, representing a 91% increase year-over-year. In 2020, we were able to attract 132 new franchisees in North America despite the material challenges faced by the overall fitness industry as a result of the COVID-19 pandemic. Additionally, franchisees frequently re-invest into our system, as 33% of new studios in 2021 and 36% of new studios in 2020 were opened by existing franchisees. We believe our strong studio-level economics have contributed to our growth.

Large and expanding franchisee base with visible organic growth.

Our large number of existing licenses sold represents an embedded pipeline to support the continued growth of our business. As of December 31, 2021, on a cumulative basis since inception, we had 4,424 franchise licenses sold globally, compared to 1,508 franchise licenses sold as of December 31, 2017 on an adjusted basis to reflect historical information of the brands we have acquired. Franchisees are contractually obligated to open studios in their territories after purchasing a franchise license. In the event that franchisees are unable to meet their contractual obligations, we have the ability to resell or reassign their territory license(s) to another franchisee in the system or our franchisee pipeline. Based on our experience as a franchisor, we believe that a significant majority of our licenses sold will convert into operating studios. Accordingly, we have the potential to substantially increase our studio base through our existing licenses sold, providing us with highly visible unit growth and further increasing our already significant scale within the boutique fitness industry.

Proven and experienced management team with an entrepreneurial culture.

Our strategic vision and entrepreneurial culture are driven by our highly experienced management team, led by our Chief Executive Officer and founder, Anthony Geisler. Mr. Geisler has direct experience scaling franchised fitness brands, having previously served as the Chief Executive Officer of LA Boxing, and has worked with many members of our leadership team for several years. Our Brand Presidents are key members of our leadership team and act as the driving force behind their respective brands. Collectively, our management team fosters an entrepreneurial culture and mentality that resonate with franchisees. The strength of our management team is illustrated by the growth of the business and the recent honors that we and our brands have received, with four brands (Club Pilates, Pure Barre, CycleBar and StretchLab) each being listed among Entrepreneur’s 2022 Franchise 500 rankings. Our leadership team has significant experience scaling franchised fitness brands and has created a culture designed to enable our future success.

Our Growth Strategies

We believe we are well-positioned to capitalize on multiple opportunities to drive the long-term growth of our business:

Grow our franchised studio base across all brands in North America.

We have the opportunity to meaningfully expand our franchised studio footprint in North America by leveraging our multiple brands and verticals, as well as our proven portability across regions and demographics.

8

We have grown our franchised studio footprint in North America from 813 open studios across 47 U.S. states, the District of Columbia and Canada as of December 31, 2017 to 1,954 open studios across 48 U.S. states, the District of Columbia and Canada as of December 31, 2021, on an adjusted basis to reflect historical information of the brands we have acquired, representing a CAGR of 25%. As of December 31, 2021, we had 1,556 franchisees and licenses for 1,806 studios contractually obligated to be opened under existing franchise agreements in North America. We sold 787 licenses in 2021 compared to 265 licenses in 2020 and 923 licenses in 2019. While we experienced delays in new studio openings in 2020 and 2021 due to the COVID-19 pandemic, we have continued opening studios throughout the COVID-19 pandemic and franchisees have opened 426 studios in North America from April 2020 through December 2021. Our track-record of successful expansion demonstrates that the experience and value offered by our brands resonate with consumers across geographies, including urban and suburban markets, ages and income levels. Our small box format and multi-brand model have enabled us to scale rapidly, as franchisees have the ability to open studios from multiple brands adjacent or in close proximity to each other, creating cross-selling opportunities and providing consumers with greater optionality. As we scale, we expect to attract multi-studio franchisees to help us accelerate our pace of growth. Based on our internal and third-party analyses by Buxton Company, franchisees could have a total of approximately 6,900 studios in the United States alone, prior to the acquisition of BFT. While no formal analysis has been conducted to assess the incremental studio opportunity attributable to BFT, Buxton expects that the addition of BFT will add approximately 1,000 more independent studio opportunities to our United States whitespace provided that we and BFT continue to operate in a manner consistent with the rest of our brands. This estimate represents the number of potential studio locations in the United States that exists in 2021 based on the criteria we consider for franchise license locations, such as customer profiles, trade area analyses and brand performance. Franchisees provide the capital to open each studio location and we provide ongoing support.

Drive system-wide same store sales and grow AUV.

We believe we can help franchisees grow same store sales and AUVs by acquiring new consumers, increasing membership penetration, driving increased spend from consumers and expanding ancillary revenue streams through our franchised studios.

9

Expand operating margins.

We have built our franchised boutique fitness platform across verticals through a series of acquisitions, investments in our brands, corporate infrastructure and leadership team. We expect to realize improved operating leverage and increase operating margins over time as we continue to expand our franchised studio base and leverage our shared services and platform. Our business model provides us with highly predictable and recurring revenue streams, attractive margins and minimal capital requirements, resulting in the ability to invest in future growth initiatives.

Grow our brands and studio footprint internationally.

We believe there is significant opportunity for further international growth, underscored by our track-record of successful expansion across a diverse array of North American markets and our recent expansion into multiple international markets, including the 2021 acquisition of BFT.

We are focused on expanding into territories with attractive demographics, including household income, level of education and fitness participation. We have developed strong relationships and executed master franchise agreements with master franchisees to propel our international growth. These master franchise agreements obligate master franchisees to arrange the sale of licenses to franchisees in one or more countries outside North America. As of December 31, 2021, we had 176 studios open internationally across Australia, New Zealand, Singapore, Saudi Arabia, Japan, Spain, the Dominican Republic and South Korea. Master franchisees were contractually obligated to sell licenses to franchisees to open an additional 956 studios in ten countries, of which master franchisees have sold 184 licenses for studios not yet opened as of December 31, 2021.

Our Brands

We have curated a portfolio of ten brands that span a variety of popular fitness and wellness verticals, including Pilates, barre, cycling, stretching, rowing, yoga, boxing, dancing, running and functional training. Collectively, our brands offer consumers specialized and personalized workout experiences that appeal to a broad range of ages, fitness levels and demographics. Under our suggested operating model, consumers may purchase recurring monthly memberships, single classes or private one-on-one training services for each brand. We have created a robust digital platform containing over 2,800 recorded workouts that can be easily accessed at-home or on-the-go. All of our brands offer workouts that can be completed both indoors and outdoors. We have also developed the XPASS, which allows consumers to participate in all of our diversified workout options while enjoying a consistent, high-quality studio experience across brands under a single monthly subscription.

10

Franchisees have the opportunity to purchase merchandise for sale in studios and online. To ensure consistency across the studio base, we require franchisees to order merchandise directly from us or approved vendors. Examples of merchandise include at-home fitness equipment such as light weights, exercise mats, balls and exercise bands, fitness apparel, such as leggings and t-shirts, and accessories, such as water bottles and towels. Merchandise is offered from popular athletic retailers, as well as fitness apparel and accessories featuring our brands’ logos and slogans.

Club Pilates

Club Pilates, founded in 2007, is the largest Pilates brand by number of studios and was approximately nine times larger than its next largest competitor as of December 31, 2021. The programming tracks Joseph Pilates’ original Reformer-based Contrology method and is modernized with group practice and sophisticated equipment. Club Pilates, our first acquisition in 2017, is fueled by the vision of making Pilates more accessible, approachable and welcoming to everyone. Our Club Pilates franchises offer consistent, high-quality Reformer-based Pilates workouts in an uplifting and supportive atmosphere. As of December 31, 2021, there were 693 operational studios and 1,060 licenses sold globally.

There are nine signature Club Pilates class formats, including introductory, cardio, strength training, stretching and suspension options, among others. Club Pilates offers an extensive training certification. Its 500-hour teacher training program includes instruction on Pilates, barre, Triggerpoint and TRX Suspension Trainers. Our training provides opportunities for technical advancement and increased earnings potential for instructors, which we believe enables the brand to attract and retain high quality instructors.

Under our suggested operating model, customers may purchase recurring monthly memberships for four, eight or unlimited monthly classes. There is also the option to purchase single walk-in classes, as well as one-on-one classes. The typical studio is approximately 1,500 square feet and is designed to allow up to 12 people to work out together. Some studios also offer private one-on-one classes.

Pure Barre

Pure Barre, founded in 2001 and acquired in 2018, is the largest barre brand by number of studios and was approximately four times larger than its next largest competitor as of December 31, 2021. Pure Barre offers a range of effective, low-impact, full-body workouts for a broad range of ages and fitness levels designed to improve strength, muscle tone, agility, flexibility and balance. Pure Barre has cultivated a large and passionate consumer base through the combination of effective programing, an energetic in-studio experience and a supportive and community-oriented culture. As of December 31, 2021, there were 612 operational studios and 734 licenses sold globally.

There are four signature Pure Barre class formats: introductory, classic barre, interval training and resistance training. Pure Barre offers a specialized multi-tiered teacher training program, which includes both classroom and on-the-job training. Our training provides opportunities for technical advancement and increased earnings potential, which we believe enables the brand to attract and retain high quality instructors. The choreography for each class format is refreshed on a quarterly basis. Under our suggested operating model, customers may purchase recurring monthly memberships for four, eight or unlimited monthly classes. There is also the option to purchase single walk-in classes. The typical studio is approximately 1,500 square feet and is designed to allow up to 26 people to work out together.

CycleBar

CycleBar, founded in 2004 and acquired in 2017, is the largest indoor cycling brand by number of studios and was approximately three times the size of its next largest competitor as of December 31, 2021. It provides a variety of low-impact, high-intensity indoor cycling workouts that are inclusive for a broad range of ages and fitness levels. CycleBar offers an immersive, multi-sensory experience in state-of-the-art “CycleTheaters,” led by specially trained instructors, enhanced with high-energy “CycleBeats” playlists and tracked using rider-specific “CycleStat” performance metrics. As of December 31, 2021, there were 249 operational studios and 516 licenses sold globally.

11

There are four signature CycleBar class formats, including metrics-focused classes and “unplugged” classes in which metrics are not tracked. CycleBar offers a specialized training program, which includes both classroom and on-the-job training. Our training provides opportunities for technical advancement and increased earnings potential for instructors, which we believe enables the brand to attract and retain high quality instructors. Under our suggested operating model, customers may purchase monthly memberships for four, eight or unlimited monthly classes. There is also the option to purchase single walk-in classes. The typical studio is approximately 2,000 square feet and is designed to allow up to 50 people to work out together.

StretchLab

StretchLab, founded in 2015 and acquired in 2017, is a leading assisted stretching brand. StretchLab was created to help people improve their health and wellness through customized flexibility services. It appeals to customers across a broad range of ages and fitness levels and is highly complementary to our broader brand portfolio. As of December 31, 2021, there were 151 operational studios and 570 licenses sold globally.

StretchLab offers one-on-one and group assisted stretching sessions. Most of StretchLab’s customers purchase one-on-one sessions. StretchLab offers an extensive training program for “Flexologist” instructors. The teacher training program includes both classroom and on-the-job training. Our training provides opportunities for technical advancement and increased earnings potential for instructors, which we believe enables the brand to attract and retain high quality instructors. Under our suggested operating model, customers may purchase monthly memberships for four, eight and unlimited group sessions per month. There is also the option to purchase single group sessions. One-on-one assisted stretching sessions can be purchased in recurring packages of four or eight classes per month, as well as in single one-on-one sessions. Our studio is designed to be between 1,000 and 1,500 square feet and is equipped with approximately ten stretch benches.

Row House

Row House, founded in 2014 and acquired in 2017, was the largest franchised indoor rowing brand by number of studios as of December 31, 2021. Row House’s class offerings incorporate personalized performance metrics, resistance training, rowing and stretching exercises to build aerobic endurance and muscular strength. The low-impact nature of rowing workouts makes Row House accessible to a broad range of consumers. Row House’s programming fosters a group fitness environment that encourages comradery and a strong sense of community, with all participants rowing in-sync. As of December 31, 2021, there were 91 operational studios and 320 licenses sold globally.

There are six signature Row House class formats: introductory, interval-based, strength training, stretching and two endurance-based. Row House offers a specialized training program for Authorized Rowing Coaches, known as “RH University,” which includes both classroom and on-the-job training. Our training provides opportunities for technical advancement and increased earnings potential for instructors, which we believe enables the brand to attract and retain high quality instructors. Under our suggested operating model, customers may purchase monthly memberships for four, eight or unlimited monthly classes. There is also the option to purchase single classes. The typical studio is approximately 2,000 square feet and designed to allow up to 25 people to work out together.

YogaSix

YogaSix, founded in 2011 and acquired in 2018, was the largest franchised yoga brand by number of studios as of December 31, 2021. Classes at YogaSix eliminate the intimidation factor that many people feel when trying yoga for the first time, offering a fresh perspective on one of the world’s oldest fitness practices. With modern-day yoga instruction, our diverse yoga and fitness programming includes movement and intensity to help customers achieve their fitness goals. As of December 31, 2021, there were 131 operational studios and 529 licenses sold globally.

There are six signature YogaSix class formats: introductory, slow flow, stretching, hot yoga, cardio and strength training. YogaSix offers an extensive accredited teacher training program for Registered Yoga Trainers. The 200-hour program includes both classroom and on-the-job training. Our training provides opportunities for technical advancement and increased earnings potential for instructors, which we believe enables the brand to attract and retain high quality instructors. Under our suggested operating model, customers may purchase recurring monthly memberships in packages of four, eight or unlimited monthly classes. There is also the option to purchase single classes. The typical studio is approximately 2,000 square feet and is designed to allow up to 40 people to work out together.

12

Rumble

Rumble, founded in 2016 and acquired by us in 2021, is a boxing-based brand offering a high energy cardio workout split between boxing drills and resistance training. The Rumble experience is built around the motto that “how you fight is how you live,” pushing consumers to develop their courage, determination, focus and stamina. Rumble studios promote inclusive and positive community vibes, welcoming consumers of all fitness levels to Rumble together. The experience is a 45-minute, 10-round, full-body cardio and strength workout crafted around specially designed water-filled, teardrop-style boxing bags. In 2021, Rumble launched Rumble TV, a live and on-demand workout platform, to bring the Rumble experience home with an extensive collection of boxing, HIIT, strength and running workouts. As of December 31, 2021, there were 14 operational studios and 201 licenses sold globally.

There are two studio formats, signature and boutique, which are balanced between the skills and drills of boxing and the transformative power of resistance training. Under our suggested operating model for the signature format, customers may purchase class packages ranging from 1 to 30 classes or monthly memberships for 12, 16 and 20 classes. There is also the option to purchase single walk-in classes. Under our suggested operating model for the boutique format, customers may purchase monthly memberships for four, eight or unlimited monthly classes. There is also the option to purchase single classes. The studios following the signature format are designed to be around 3,500 to 4,500 square feet to allow about 60 people to work out together, while studios following the boutique format are designed to be around 2,500 square feet to allow about 48 people to work out together.

AKT

AKT, founded in 2013 and acquired in 2018, is a full-body workout that combines cardio dance intervals with strength and toning that are effective and accessible for all fitness levels. Designed by celebrity trainer Anna Kaiser, AKT is fueled by positivity and a belief that movement has a powerful, lasting impact. With a high-energy atmosphere and lively music, workouts are designed to push customers to sweat, dance and burn calories. As of December 31, 2021, there were 28 operational studios and 112 licenses sold globally.

There are four signature AKT class formats: dance-based, cardio and strength circuits, strength training intervals and toning. AKT offers a specialized training program for Authorized AKT Instructors, which includes both classroom and on-the-job training. Our training provides opportunities for technical advancement and increased earnings potential for instructors, which we believe enables the brand to attract and retain high quality instructors. Under our suggested operating model, customers may purchase recurring monthly memberships for four, eight and unlimited monthly classes. There is also the option to purchase single classes. The typical studio is approximately 2,000 square feet and is designed to allow approximately 25 people to work out together.

Stride

Stride, founded in 2017 and acquired in 2018, is a treadmill-based cardio and strength workout established to demonstrate to consumers across a broad range of ages and fitness levels that they can enjoy running. Stride offers engaging programming led by dynamic authorized trainers, with state-of-the-art equipment and energizing music. As of December 31, 2021, there were 10 operational studios and 88 licenses sold globally.

The supportive and inclusive environment at Stride fosters a strong sense of community that continues outside of the studio. Stride customers participate in running groups alongside Stride instructors for organized road races and other athletic events. These events deepen customers’ connection and loyalty to the Stride brand.

There are three signature Stride class formats: interval, endurance-based and strength training. Under our suggested operating model, customers may purchase monthly memberships for four, eight and unlimited monthly classes. There is also the option to purchase single walk-in classes. The typical studio is designed to be at least 2,000 square feet and is designed to allow 25 people to work out together.

13

BFT

BFT, founded in 2017 and acquired by us in 2021, offers community-based 50-minute functional, high-energy strength, cardio and conditioning-based classes across multiple workout programs, each designed to achieve the unique health goals of its members. Training sessions are overseen by highly qualified coaches in a dynamic group environment. As of December 31, 2021, there were two operational studios in North America. As of December 31, 2021, there were 151 operational studios and 294 licenses sold globally.

There are thirteen signature BFT class formats, consisting of cardio, high intensity interval training and strength, that are programmed in specific layouts to progress members through a strength training program. BFT offers a specialized training program for BFT coaches, which includes online training, classroom and on-the-job training. Under our suggested operating model, customers may purchase monthly memberships for four, eight and unlimited monthly classes. There is also the option to purchase single walk-in classes. The typical studio is approximately 2,500 square feet and is designed to allow 36 people to work out together.

Our Franchise Model

Franchising Strategy

We rely on our franchising strategy to grow our brands’ global footprint in a capital efficient manner. Our franchise model leverages the local market expertise of highly motivated owners, our proven Xponential Playbook and our corporate platform. The model has enabled us to scale our system-wide studio footprint at a CAGR of 27% from 2017 to 2021.

As of December 31, 2021, we had sold a total of 4,062 franchise licenses on a cumulative basis since inception in North America, with approximately 18% of licenses owned by single-unit franchisees and approximately 82% of licenses owned by multi-unit franchisees. As of December 31, 2021, 56% of franchisees owned more than one studio and about 95% of franchisees owned a single brand of studios. The largest franchisee in North America owned 46 licenses, representing approximately 1.1% of our total franchise licenses sold in North America as of December 31, 2021.

When considering potential franchisees, we evaluate their prior experience in relationship-oriented businesses, level of hands-on involvement in their communities, financial history and available capital and financing.

Franchisee Selection Process

We created a disciplined and highly effective franchisee development program for our portfolio of brands and franchisees. The franchisee network in North America has grown rapidly from 835 franchisees as of December 31, 2017 to 1,556 franchisees as of December 31, 2021, representing a CAGR of 17%.

When evaluating new potential franchisees in North America, we typically look for the following characteristics:

The potential franchisees must also meet the following eligibility criteria:

14

We divide the franchisee selection process into five distinct stages:

Franchise Agreements

For each of our brands’ franchised studios, we enter into a franchise agreement covering standard terms and conditions. Under our franchise agreement, we grant franchisees the right to access our brands in an exclusive area or territory after taking into account population density and demographics based on our internal and third-party analyses. The proposed location must be approved by us, and each franchisee is responsible for the selection, acquisition and development of the site from which to build the studio. Our franchise agreement requires that the franchisee operates within its designated market areas.

Our franchise agreements have an initial ten-year term. We can terminate the franchise agreement if a franchisee is in default thereunder, has failed to meet our minimum monthly gross revenue quotas or has failed to select a site for the studio that meets our approval within an indicated time period. From inception to December 31, 2021, of our licenses sold, 302 had been terminated in North America and two had been terminated internationally. We expect franchisees to meet and maintain minimum monthly gross revenue quotas by the first and second anniversary of their studio opening. Failure to meet these quotas for 36 consecutive months at any time during the term of the franchise agreement can result in the institution of a mandatory corrective training program or termination of the franchise agreement. We require franchisees to open their studio for regular, continuous business within a specified timeline. Within six months of the expiration of the initial ten-year term, franchisees have the opportunity to renew for one or two additional five-year terms, subject to the terms and conditions prevailing at the time of renewal.

Our franchise agreements require franchisees to comply with our standard operating methods that govern the provision of services, use of vendors and sale of merchandise. These provisions require that franchisees purchase equipment only from an approved list of vendors, and may generally provide products, classes and services only from us or an approved list of suppliers. We reserve the right to charge a penalty fee for each day that a franchisee offers or sells unauthorized products or services from the studio.

Our franchise agreements require franchisees to pay an initial, nonrefundable franchise fee per studio.

Beginning on the day that a studio starts generating revenue from its business operations, franchisees are required to pay us a monthly royalty fee based on gross sales.

15

Attractive Franchisee Return Profile

The Xponential Playbook is designed to help franchisees achieve compelling AUVs, strong operating margins and an attractive return on their invested capital. Studios are generally designed to be between 1,500 and 2,500 square feet in size, depending on the brand, which contributed to a relatively low average initial franchisee investment of approximately $350,000 in 2021 and 2020, including all leasehold improvements and required studio furniture, fixtures and equipment. We believe that our scale and vendor relationships enable us to offer equipment and merchandise to franchisees at a significantly lower cost than if they were to acquire it on their own. By utilizing the Xponential Playbook, our model is generally designed to generate, on average, an AUV of approximately $500,000 in year two of operations and studio-level operating margins ranging between 25% and 30%, resulting in an unlevered cash-on-cash return of approximately 40%.

New Studio Development

Our small-box format studios have the flexibility to be located in a variety of retail buildings and shopping centers, and we consider locations in both high- and low-density markets. We seek out locations with (i) our target customer demographics, (ii) high visibility and accessibility and (iii) favorable traffic counts and patterns. We use internal and third-party analytic tools to access demographic data that we use to analyze potential new and existing sites and markets for franchisees. We assess population density, current tenant mix, layout and potential competition, among other factors. As a result of boutique fitness consumers’ affinity for trying multiple workout types, we have the ability to place our different brands within close proximity to each other. Our team follows a detailed approval process to review potential sites and seek to ensure that each site aligns with our strategic growth objectives and the Xponential Playbook.

We guide franchisees through the site selection, build-out and design processes during the development of their studios, ensuring that the studios conform to the physical specifications for their respective brands. Prior to opening, we offer franchisees a list of designated territories in which they may open a new studio. Each franchisee is responsible for selecting, acquiring and leasing a site, but they must obtain site approval from Xponential.

Franchise Development Team

We have a dedicated sales team to help promote and coordinate sales and resales of franchises at the corporate level. We have created a scalable and sustainable model through which we identify potential franchisees. In addition, we have a team dedicated to training and supporting franchisees in lead generation, sales conversion and customer retention support.

We also work with third-party brokers to generate sales leads for potential new franchisees.

Studios

As of December 31, 2021, franchisees operated 1,932 studios system-wide, across 48 U.S. states and the District of Columbia, as well as 22 studios in Canada, 132 studios in Australia, 13 studios in New Zealand, 13 studios in Singapore, 11 studios in Saudi Arabia, four studios in Japan, one studio in Spain, one studio in the Dominican Republic and one studio in South Korea. In 2021, franchisees opened 240 studios across North America as well as 94 studios internationally on an adjusted basis to reflect historical information of the brands we have acquired. As of December 31, 2020, franchisees operated 1,697 studios system-wide, across 48 U.S. states and the District of Columbia, as well as 17 studios in Canada, 68 studios in Australia, two studios in New Zealand, three studios in Singapore, six studios in Saudi Arabia, two studios in Japan and one studio in South Korea on an adjusted basis to reflect historical information of the brands we have acquired.

Operating company-owned studios is not a component of our business model. Following the significant disruption to the global fitness industry caused by the COVID-19 pandemic, however, we took ownership of a greater number of studios than we would expect to hold in the normal course of our business. While operating studios is not a component of our business model, we currently hold a small number of strategic transition studios as, on occasion, we take ownership of such studios for a limited time while facilitating the transfer of these studios to new or existing franchisees ("company-owned transition studios"). As of December 31, 2021, 2020 and 2019 we had 25, 40 and four company-owned transition studios, representing 1.2%, 2.2% and 0.3% of the global studio base, respectively.

16

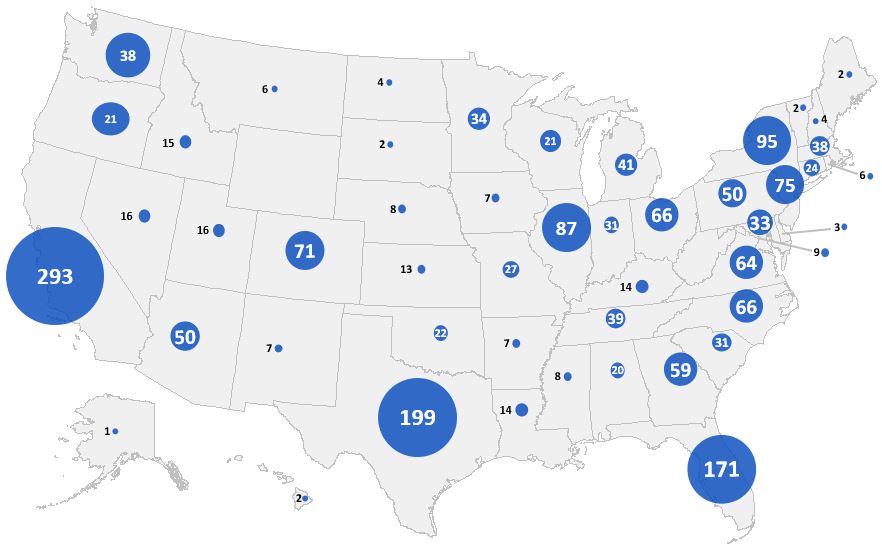

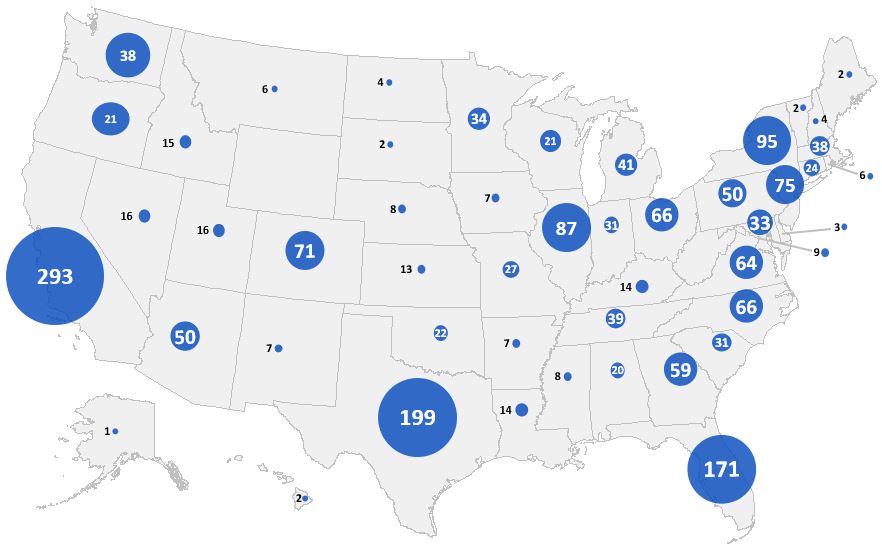

The map below shows open studios by U.S. state as of December 31, 2021:

Note: The 25 company-owned transition studios are included in the count of total franchised studios. As we are in the process of refranchising these studios, we expect that they will be owned and operated by franchisees in the future.

Brand |

Club |

|

Pure |

|

CycleBar |

|

Stretch |

|

Row |

|

YogaSix |

|

AKT |

|

Stride |

|

Rumble |

|

BFT |

|

||||||||||

Number of U.S. states |

|

43 |

|

|

47 |

|

|

40 |

|

|

31 |

|

|

25 |

|

|

31 |

|

|

14 |

|

|

5 |

|

|

4 |

|

|

2 |

|

We continue to drive the international expansion of our studio base. We currently have in place master franchise agreements that grant master franchisees the right to sell licenses to potential franchisees in ten countries that we have targeted for near-term expansion. As of December 31, 2021, there were 176 studios open internationally, and the master franchisees were contractually obligated to sell licenses to franchisees to open an additional 956 studios in ten countries, of which master franchisees have sold 184 licenses for studios not yet open as of December 31, 2021. As of December 31, 2021, franchisees were contractually committed to open an additional 1,806 studios in North America under existing franchise agreements.

17

Fitness Equipment

Our franchised studios contain state-of-the-art fitness equipment from an array of suppliers. We believe that the quality of the equipment enriches the customers’ in-studio experience and thereby enhances their brand loyalty. To ensure consistency across the studio base, we require franchisees to order equipment and supplies directly from us or approved vendors. Franchisees are required to order replacement or upgraded equipment within five to ten years depending on the manufacturers’ guidelines. Franchisees also must use our approved vendors for equipment maintenance, who provide warranties on certain equipment purchased from them. As the largest franchisor in the industry, we have significant scale that enables us to negotiate competitive pricing from our suppliers. As a result, we believe that we offer equipment at more attractive pricing than franchisees could otherwise procure on their own, lowering the build-out cost and improving unit economics.

Our Digital Offering

We believe there is an opportunity to capitalize on the growing consumer demand for digital and at-home fitness solutions by providing a digital platform that complements and enhances the attractiveness of our in-studio offerings. In addition to increasing engagement with and retention of our existing in-studio members, our digital platform enables us to reach new consumers in markets without a physical footprint and generate incremental revenue for both us and franchisees with limited incremental cost. As a result, our brands can deliver high-quality fitness content and maintain strong levels of member engagement both in the studio and at home. Our digital offering is available 24 hours a day, 7 days a week and delivers highly engaging live streamed and on-demand fitness classes from all of our brands, except Rumble and BFT. We cover the cost of production for our digital content. Currently, members receive all of our Pure Barre video content at no extra charge when they purchase an unlimited membership at a Pure Barre studio, and in that case, we provide that digital access at no charge to the relevant franchisee. Other members across our brands may purchase a digital subscription from a studio or directly from us. We receive a platform fee from franchisees for each digital subscription that is purchased from a studio.

As of December 31, 2021, our digital platform had over 55,000 users, of which over 24,000 were paid subscribers and the balance received digital subscriptions as part of an unlimited Pure Barre membership. We offer digital subscriptions on an individual brand basis, as well as an all-access package for eight of our brands. Our digital platform encompasses over 2,800 digital workouts with multiple class formats within each brand, and we expect to continue to grow that content. Our digital platform is attractive for franchisees as it allows them to upsell a better value proposition to their members. It also allows us to market local studios to standalone digital members based on their geographic location. We believe that our digital platform builds significant brand awareness and enhances cross-sell opportunities across our brands and between in-studio memberships and digital subscriptions.

Marketing

Marketing Strategy

Our marketing strategy is designed to highlight our leading brand portfolio, the compelling value proposition of our brands and the unique attributes and benefits of boutique fitness workouts. Each brand has a dedicated marketing team that is focused on building brand awareness, generating new customer leads and increasing studio traffic at the national and local level. We leverage our corporate platform and marketing expertise to develop tailored marketing strategies to capitalize on each of our brands’ potential.

Marketing Spending

National advertising. We manage a marketing fund for franchisees, with the goal of building national awareness for our brands. We focus our marketing efforts on national advertising and media partnerships, developing and maintaining creative assets to support local sales throughout the year, and building and supporting the Xponential Fitness community via digital and social media for each of our brands. Our franchise agreements require franchisees to contribute 2% of their monthly gross sales to the marketing fund of their respective brand. Our marketing funds have enabled us to spend approximately $13.0 million, $7.1 million and $8.2 million in 2021, 2020 and 2019, respectively, to increase national awareness of our brands. We believe this is a powerful marketing tool as it allows us to increase brand awareness in new and existing markets.

18

Local marketing. Our franchise agreements require franchisees to spend at least $1,500 per month on approved local marketing to support promotional sale periods throughout the year and continue to build the brand in local markets. All franchised studios are supported by our dedicated franchisee marketing team, which provides guidance, tracking, measurement and advice on best practices. Franchisees spend their marketing dollars in a variety of ways to promote business at their studios on a local level. These methods typically include media vehicles that are effective on a local level, including direct mail, outdoor (including billboards), social media and radio advertisements and local partnerships and sponsorships.

Social media. We have an engaged social media platform for each of our brands, which we believe further raises brand awareness and creates a community among our members. Each brand has a dedicated social media page run by us, and we also maintain a corporate social media page where we seek to engage personally with customers. In addition, franchisees operate social media accounts at the local level. We provide franchisees with social media consulting during the pre-opening phase in order to help them maximize their social impact. We believe that local social media pages are additive to the studio-level community and deepen our brands’ connection with consumers.

Digital. We utilize digital advertising at the corporate level to drive awareness for our digital platform offerings. For example, in March 2021, we launched an Apple Watch integration designed to offer an enhanced member experience across all our brands, other than BFT. The integration allows Xponential members and guests who utilize Apple Watch to view upcoming classes, check-in to a class and track real-time workout performance data. Each brand’s app will integrate directly with Apple Watch. Members at participating studios also have the option to join our “Earn Your Watch” challenge, earning back the value of their Apple Watch when they purchase their device through an Xponential brand website and complete a set number of workouts per month. We believe that our partnership with Apple Watch will further drive excitement and enthusiasm across the Xponential consumer base, while also helping to increase membership engagement and retention.

Competition

Although we offer boutique fitness experiences, we believe we compete with both fitness and non-fitness consumer discretionary spending alternatives for consumers’ time and resources.

Franchisees compete with other health and fitness club industry participants, including:

The health and fitness club industry is highly competitive and fragmented, and the number, size and strength of competitors vary by region. Some of our competitors may have greater name recognition nationally or locally or an established presence in local markets and some have corporate relationships that facilitate their acquisition of new consumers. These risks are more significant internationally, where we have a limited number of studios and brand recognition. Please also see “Business-Our Competitive Strengths.”

19

We also compete to sell franchises to potential franchisees who may choose to purchase franchises from other boutique fitness operators, but who may also consider purchasing franchises in other industries such as restaurants and personal care. We compete with other franchisors on the basis of the expected return on investment of franchisees and the value propositions that we offer for franchisees.

Our competition continues to increase as we expand into new markets and add studios in existing markets. See “Risk Factors—Risks Related to our Business and Industry—We operate in a highly competitive market and we may be unable to compete successfully against existing and future competitors.”

Suppliers

We require franchisees to make most purchases related to the build out and operation of their studios from us or our approved vendors. This helps us ensure the timelines of build outs and the maintenance of consistent studio quality within each brand. We sell equipment purchased from third-party equipment manufacturers to franchised studios in North America. Franchisees outside North America must purchase equipment from third-party equipment manufacturers approved by us. We also have various approved suppliers of fitness accessories and apparel.

Vendors arrange for delivery of products and services either directly to our warehouse or to franchisee studios. We continually re-evaluate our supplier relationships to ensure we and franchisees obtain competitive pricing and high-quality equipment, merchandise and other items.

Employees

As of December 31, 2021, we had approximately 322 employees at our corporate headquarters, of which approximately 104 were part-time employees. We also had approximately 300 employees at our company-owned transition studios as of December 31, 2021, of which approximately 286 were part-time employees. None of our employees are represented by labor unions, and we believe we have a good relationship with our employees.

Xponential franchises are independently owned and operated businesses. As such, employees of franchisees are not employees of Xponential Fitness.

Information Technology and Systems

We recognize the value of enhancing and extending the uses of information technology (“IT”) in virtually every area of our business. Our IT strategy is aligned to support our business strategy and operating plans. We maintain an ongoing program to monitor, replace or upgrade key IT services and infrastructure.

The studios use a uniform third-party hosted studio management system for enrolling members and managing member database information including personally identifiable information and payment processing. In addition, this management system tracks and analyzes key operating metrics such as membership statistics, cancellations, cross-studio utilization, member tenure and demographics profiles.

We continue to create a more customizable and efficient experience for members through updated digital tools, including enhanced websites and mobile applications. These digital tools enable consumers to search studio locations, browse class schedules and sign up for classes. We continue to enhance the accessibility of our digital tools to increase our online presence and member engagement.

Through our third-party hosted studio management system, we provide franchisees access to an informational management system to receive informational notices, operational resources and updates, training materials and other franchisee communications.

Our back-office computer systems are comprised of a variety of technologies designed to assist the operation of our business. These include a third-party hosted accounting and financial system, a SaaS solutions system to manage franchisees’ leases and franchisee agreements, a third-party hosted payroll system, an inventory and online store management system and a customer relationship management system.

20

Intellectual Property

At December 31, 2021, we own approximately 71 registered trademarks and service marks in the United States and approximately 321 registered trademarks and service marks in other countries, including “Xponential,” “Pure Barre,” “StretchLab,” “Row House,” “YogaSix,” “Club Pilates,” “CycleBar,” “Rumble,” “AKT,” “Stride” and “BFT.” We believe the Xponential name, and the marks associated with our ten brands are of value and are important to our business. Accordingly, as a general policy, we pursue registration of our marks in the United States and select international jurisdictions, monitor the use of our marks in the United States and internationally and oppose any unauthorized use of our marks.

We license the use of our marks to franchisees and third-party vendors through our franchise agreements and vendor agreements. These agreements restrict third parties’ activities with respect to use of our marks. Our franchise agreements impose brand standards requirements and require franchisees to inform us of any potential infringement of our marks.

We register some of our copyrighted material and otherwise rely on common law protection of our copyrighted works. Such registered copyrighted materials are not material to our business.

We also license some intellectual property from third parties for use in our franchised studios. Such licenses, including our music licenses, are not material to our business. Franchisees also license certain intellectual property for use in their studios, including music in some cases.

Government Regulation

We and franchisees are subject to various federal, state, provincial and local laws and regulations affecting our business.

We are subject to a trade regulation rule on franchising, known as the FTC Franchise Rule, promulgated by the U.S. Federal Trade Commission (the “FTC”), that regulates the offer and sale of franchises in the United States and requires us to provide to all prospective franchisees certain mandatory disclosure in a Franchise Disclosure Document (“FDD”). In addition, we are subject to state franchise sales laws in approximately 19 U.S. states that regulate the offer and sale of franchises by requiring us to make a business opportunity exemption or franchise filing or obtain franchise registration prior to making any offer or sale of a franchise in those states and to provide a FDD to prospective franchisees.

We are subject to franchise sales laws in six provinces in Canada that regulate the offer and sale of franchises by requiring us to provide a FDD in a prescribed format to prospective franchisees and that further regulate certain aspects of the franchise relationship. We are also subject to franchise relationship laws in at least 22 U.S. states that regulate many aspects of the franchise relationship, including renewals and terminations of franchise agreements, franchise transfers, the applicable law and venue in which franchise disputes must be resolved, discrimination and franchisees’ right to associate, among others. In addition, we and franchisees may also be subject to laws in other foreign countries where we or they do business.

We and franchisees are also subject to the U.S. Fair Labor Standards Act of 1938, as amended, similar state laws in certain jurisdictions, and various other laws in the United States and Canada governing such matters as minimum-wage requirements, overtime and other working conditions. A significant number of our and franchisees’ employees are paid at rates related to the U.S. federal or state minimum wage, and past increases in such minimum wages have increased labor costs, as would future increases.

Our and franchisees’ operations and properties are subject to extensive U.S. and Canadian federal, state, provincial and local laws and regulations, including those relating to environmental, building and zoning requirements. Our and franchisees’ development of properties depends to a significant extent on the selection and acquisition of suitable sites, which are subject to zoning, land use, environmental, traffic and other regulations and requirements.

We and franchisees are responsible at the studios we operate for compliance with state laws that regulate the relationship between health clubs and their members. Nearly all states have consumer protection regulations that limit the collection of monthly membership dues prior to a studio opening, require certain disclosure of pricing information, mandate the maximum length of contracts and “cooling off” periods for members (after the purchase of a membership), set escrow and bond requirements, govern member rights in the event of a member relocation or disability, provide specific member rights when a health club closes or relocates, or preclude automatic membership renewals.

21

We and franchisees primarily accept payments for our memberships through electronic fund transfers from members’ bank accounts and, therefore, are subject to both federal and state legislation and certification requirements, including the Electronic Funds Transfer Act. Some states, such as New York, Massachusetts and Tennessee, have passed or considered legislation requiring gyms and health clubs to offer a prepaid membership option at all times and/or limit the duration for which such memberships can auto-renew through electronic fund transfers, if at all. Our business relies heavily on the fact that our memberships continue on a month-to-month basis after the completion of any initial term requirements, and compliance with these laws, regulations, and similar requirements may be onerous and expensive, and variances and inconsistencies from jurisdiction to jurisdiction may further increase the cost of compliance and doing business. States that have such health club statutes provide harsh penalties for violations, including membership contracts being void or voidable.

Additionally, the collection, maintenance, use, disclosure and disposal of individually identifiable data by us, or franchisees are regulated at the federal, state and provincial levels as well as by certain financial industry groups, such as the Payment Card Industry, Security Standards Council, the National Automated Clearing House Association and the Canadian Payments Association. Federal, state and financial industry groups may also consider from time to time new privacy and security requirements that may apply to us or franchisees and may impose further restrictions on our or their collection, disclosure and use of individually identifiable information that are housed in one or more of our or their databases.

Available information

Our website address is www.xponential.com, and our investor relations website is located at http://investor.xponential.com. Information on our website is not incorporated by reference herein. Copies of our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and our Proxy Statements for our annual meetings of stockholders, and any amendments to those reports, as well as Section 16 reports filed by our insiders, are available free of charge on our website as soon as reasonably practicable after we file the reports with, or furnish the reports to, the Securities and Exchange Commission (the “SEC”). The SEC maintains an Internet site (http://www.sec.gov) containing reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

22

Item 1A. Risk Factors.